Third Party Risk Management Solutions

Get a consolidated view of the risks posed by your vendors, suppliers, and service providers with a third-party risk management solution. Build a vendor register, automate vendor risk assessments, implement controls, and monitor performance against SLAs and KPIs to effectively manage third-party risk.

Monitor Supplier Performance

Establish a vendor library that captures critical data regarding contract details, SLAs, and KPIs – enabling continuous monitoring of supplier performance against key metrics.

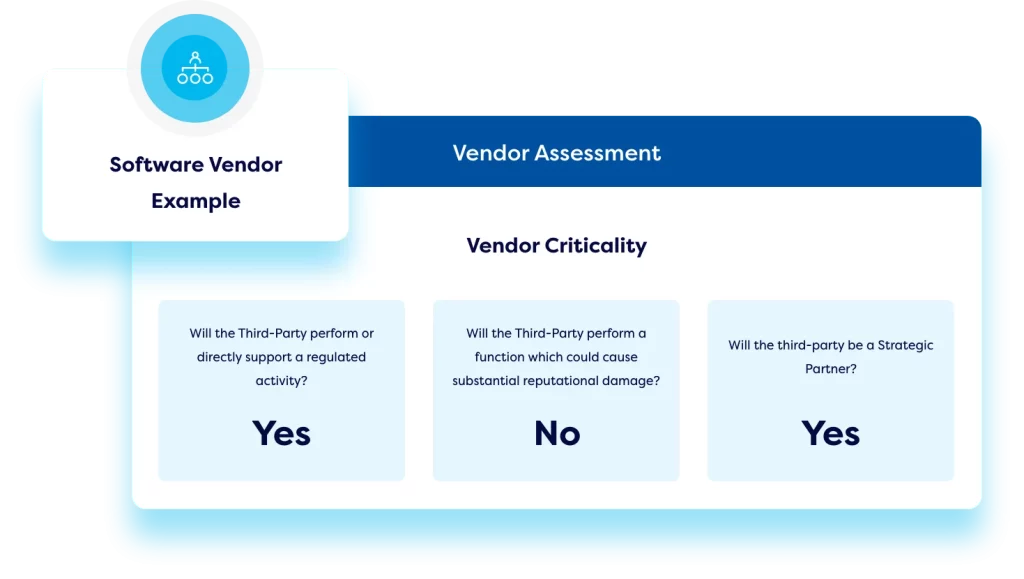

Automate Vendor Risk Assessments

Utilize our third party management system to automate vendor risk assessments. Staff and suppliers can complete these assessments via online forms that integrate directly into the solution.

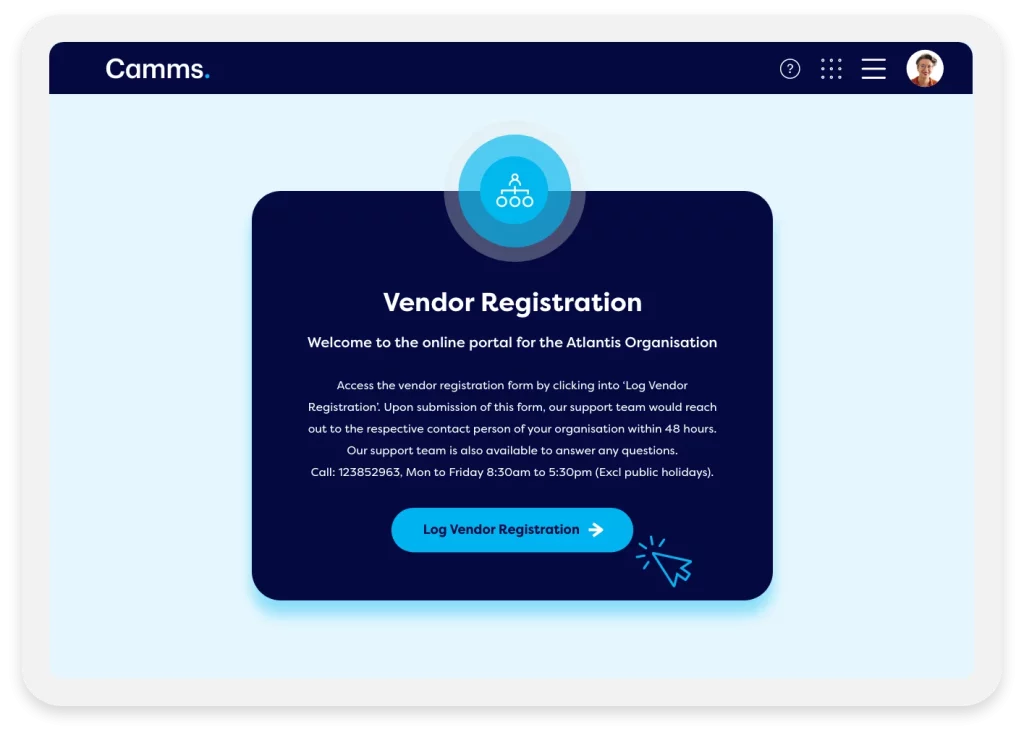

Vendor Portal

Provide third parties with access to a vendor portal where they can complete questionnaires, surveys, and risk assessments online – capturing ample data to easily compare vendors & understand risk.

Third-Party Risk Intelligence

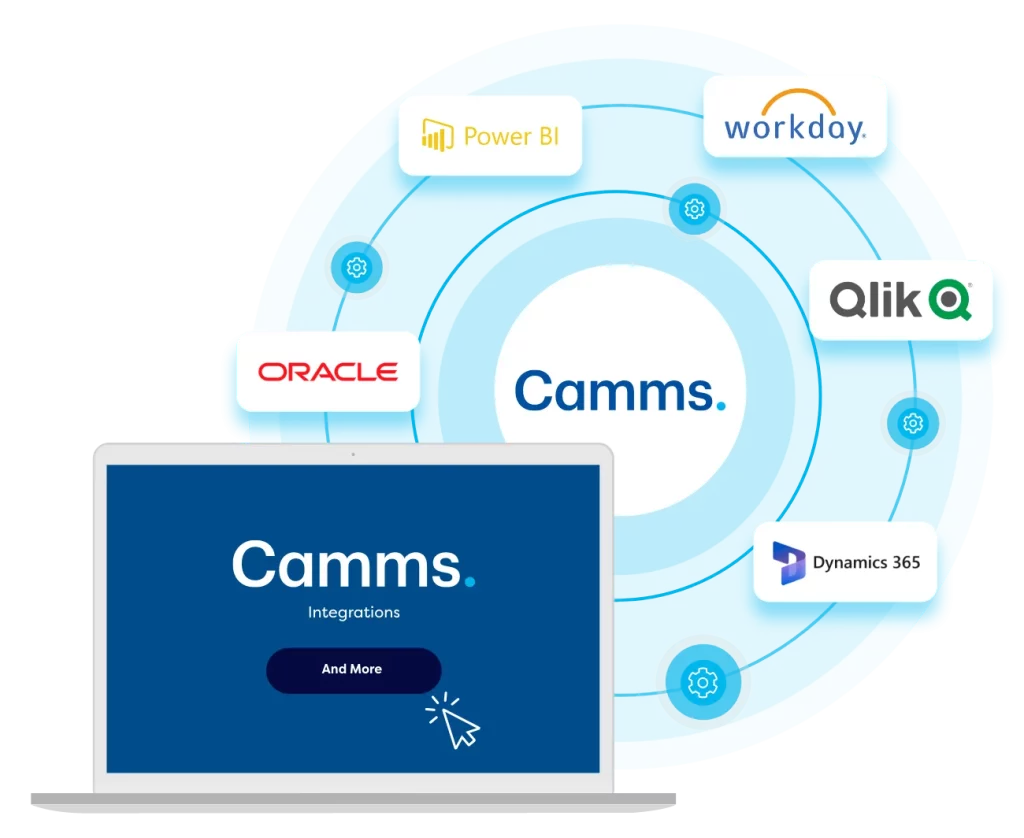

Integrate our third party risk solution with third party risk intelligence providers via API connections to understand vendor risks such as ethical standpoint, financial stability, legal & regulatory issues, and cybersecurity breaches.

Third party risk management solutions capabilities

Online vendor register

Create an online vendor register within our third-party risk management solution, capturing essential details for each vendor, including costs, contracts, key contacts, Service Level Agreements (SLAs), and Key Performance Indicators (KPIs). Formalize the onboarding and offboarding process, and conduct vendor risk assessments, score-carding, and benchmarking. All data is synced to the relevant vendor profile, enabling easy vendor comparison, vendor rating, and the addressing of sub-standard supplier performance.

Flexible vendor risk management

Staff can complete vendor risk assessments online, with all information feeding directly into the third-party risk solution to simplify vendor risk management. Organisations can customise forms for different types of suppliers to ensure all critical evaluation steps are covered. The Camms third party risk management automation tool allows companies to create conditional workflows for third-party risk assessments. Organisations can design extended questionnaires to capture and evaluate key attributes, use responses to determine alternative routes in the workflow. Workflows can also be used to facilitate approvals & signoffs, conduct regular reviews with automated alerts, and track the progress of any treatment actions.

Online vendor portal

Eliminate the need to manually email questionnaires and compile responses with the Camms third-party risk management vendor portal. Vendors can log in to our third party risk solution and complete questionnaires and surveys online. Results are captured directly within the system – integrating seamlessly into the broader workflow. Once a vendor completes their assessment, it can trigger alerts and initiate the next steps for internal staff to progress the evaluation – ensuring effective third-party risk management.

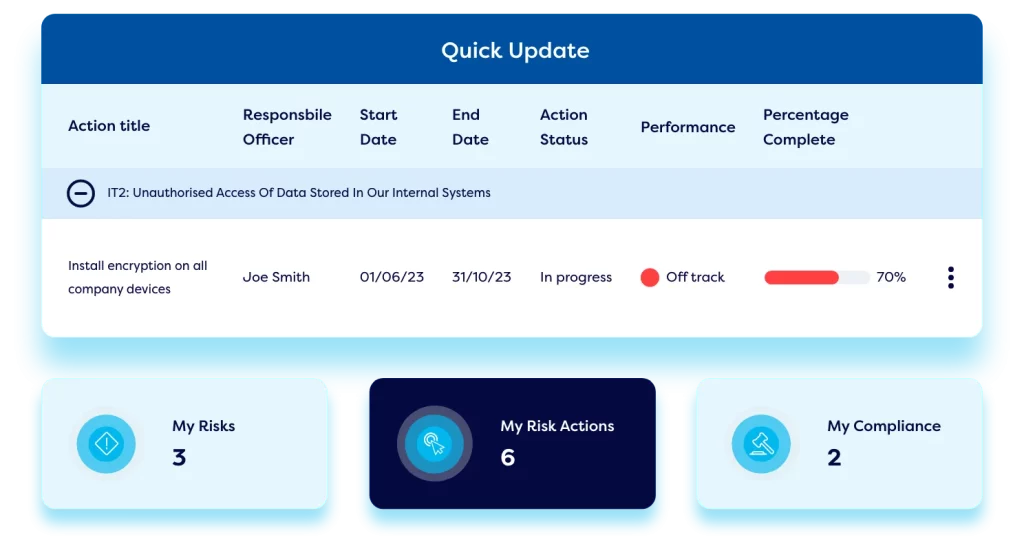

Live dashboards & reports

Our third-party risk management solution enables organisations to generate reports on vendor risk exposure, helping executives understand dependencies on each supplier and the associated risks. Additionally, it provides reporting on vendor performance against KPIs, SLAs, and industry benchmarks – ensuring successful third-party risk management.

Third-party risk intelligence via APIs

Improve your third-party risk management program by utilising our API integration technology to seamlessly connect vendor profiles with external third-party risk intelligence providers, obtaining real-time updates on supplier finances, sustainability ratings, sanctions listings, cybersecurity rankings, and more. This information is automatically updated in the vendor’s record within the Camms third-party risk management solution, feeding into reporting and analytics.

Regulatory compliance

Ensure your vendors and suppliers adhere to relevant compliance obligations using our third-party risk management solutions. Camms’ regulatory compliance capabilities integrate with our third-party risk management framework – this allows firms to easily access key compliance information and incorporate it into vendor assessments, ensuring clear compliance demonstration during supplier audits.

Your Third-Party Risk Management Solution Resources

The latest and hottest pieces of third-party risk management content to stay in the know.

Using Automation to Build a Consolidated View of Third-Party Risk

In this eBook, experts explain the intricacies of an effective third-party risk management program. They share tools & techniques to automate the management process and reveal how organisations can get a holistic view of vendor risk.

3 Ways to Automate Third-Party Risk Management

In this blog discover why third-party risk management automation grants insight into vendor and supplier operations, clarifying the potential risks they carry for your organisation.

From Excel to Excellence: Turning Your Risk Data into Insights & Decisions

In this eBook, we explore why spreadsheets are outdated for risk management and help you to identify if your business is ready to swap spreadsheets for an automated GRC solution. Plus, we detail the top 10 reasons to switch from spreadsheets to software.

Why choose a third-party risk management solution from Camms?

Next Generation User Interface

Our third party risk solution features an advanced, intuitive user interface (UI), making it easy for your entire workforce to perform vendor risk-related tasks. All supplier risk data is captured within the platform, providing comprehensive third-party risk analytics.

Align Vendor Risk & Compliance to Business Objectives

Choose a third-party risk management solution like Camms’ that integrates vendor risk with organisational objectives and business processes. This enables your team to select low risk, high performing suppliers & service providers that ensure operations remain within your risk appetite.

Data Security & Privacy

The Camms integrated third party risk management platform is highly secure and certified to highly regarded information security standards, including SOC Type 1&2, ISO 27001, and Cyber Essentials. The software features a complex permissions hierarchy, encryption, and audit trails to ensure data privacy and compliance with your security teams IT security standards.

Discover more about the Camms Third-Party Risk Management Solution

Frequently asked questions about

third-party risk management solutions

Third-party risk management involves the process of identifying, assessing, and mitigating risks associated with outsourced business functions, suppliers, and external vendors. Companies rely on third parties for services, such as IT support, supply chain operations, financial services, and contract and delivery work – which can introduce vulnerabilities if not properly managed. Third-party risk management ensures that these external entities do not pose security, compliance, or operational threats to the organisation.

To manage these risks and minimise supply chain disruptions, businesses typically conduct thorough due diligence on potential third parties, including background checks, financial stability assessments, and compliance evaluations. Ongoing monitoring and regular audits are also crucial to address any emerging risks or issues throughout the duration of the business relationship, this involves conducting regular vendor risk assessments & compliance checks and monitoring vendor performance against SLAs & KPIs.

Third-party risk management solutions are software platforms designed to help organisations identify, assess, and mitigate the risks associated with their external partners and vendors. These solutions often include functionality such as automated risk assessments, real-time risk monitoring, third-party risk intelligence integrations, and compliance tracking. They help streamline the process of evaluating third parties, from initial vetting to ongoing oversight, ensuring that potential risks are managed effectively. By automating processes these solutions modernize vendor and supplier risk management and address the cybersecurity threat landscape relating to IT vendors.

Third-party risk management solutions often encompass best practices and frameworks for risk evaluation across various industries. This includes best-practice risk assessments, setting up protocols for supplier due diligence, and establishing contingency plans. By implementing these solutions, organisations can enhance their ability to detect vulnerabilities, maintain compliance, and protect their business interests while working with external partners.

The Key features of a third-party risk management solution include:

- Vendor library – Build a complete library of all your vendors capturing key details around contract, pricing, key contacts, SLAs, and KPIs to easily compare vendors and build a comprehensive profile of each vendor

- Comprehensive risk assessment capabilities – Staff and vendors can complete risk assessments using online forms with all data feeding directly into the platform. Assessment forms can easily be customised based on different types of vendors. Build a vendor risk register and monitor vendor risk and implement controls to reduce the risk in problem areas.

- Real-time risk monitoring – Firms can use a third-party risk management solution to monitor vendor risk by setting up a vendor risk register linked to an online vendor library. They can monitor risk levels based on external risk intelligence and live supplier transactional data that can be pulled into the platform via API integrations to monitor risk levels and supplier performance.

- Robust reporting functionalities – Third party risk platforms make it easy to report on vendor risk levels and supplier performance through a variety of dashboards and reports – making it simple for firms to proactively identify, mitigate, and accept risks associated with third-party relationships.

- Third-party risk intelligence – Integrations with external risk assessment tools help evaluate the potential threats and vulnerabilities posed by third parties, utilising criteria such as financial stability, compliance history, and operational risks.

- Automated workflows – Best-practice workflow automation ensures any emerging supplier issues are promptly addressed.

- Vendor compliance – Many TPRM platforms allow you to monitor supplier performance and regulatory compliance and certification status – enabling companies to ensure they are working with reputable suppliers.

Automating third-party risk management with a TPRM (Third-Party Risk Management) solution offers several key benefits?

- Enhanced efficiency as streamlining risk assessment processes reduces the time and manual effort required to evaluate and monitor third-party risk – improving your third-party risk program.

- Increased risk intelligence as integrations with third-party risk intelligence providers provide key insights into headline news relating to each supplier covering key topics like, IT security threats, credit history, and compliance violations.

- TPRM software improves your vendor risk management program by providing greater visibility of vendor risk due to live dashboards and reporting outputs based on live supplier data and risk assessment results.

- Third-party risk management solutions eliminate admin with automated workflows, online forms, and automated reporting outputs. This reduced admin and increased efficiency streamlines third-party risk management.

- Risk reduction – Vendor risk is reduced thanks to an active control library and workflows to implement risk mitigation strategies.

- Faster risk response – Automation tools can quickly gather and analyze data, flagging potential risks and compliance issues in real time, which helps organisations respond faster to emerging threats and maintain operational agility – ensuring customers remain unaware of any vendor issues, keeping your reputation intact.

- Accuracy and consistency – Automation improves accuracy and consistency in risk management – using standardized algorithms and predefined criteria to reduce the likelihood of human error and ensure that risk evaluations are consistently applied across all third-party interactions.

- Better decision-making – The third party risk intelligence provided by third-party risk platforms improves your third-party management program by enhancing decision-making when selecting vendors.

- Third-party risk platforms enable firms to address different types of risk stemming from third parties including reputational risk, cybersecurity risk, strategic risk, and compliance risk – helping firms to assess, manage and monitor those risks.

- A third party risk management solution enables firms to integrate services from third party vendors into core business functions, ensuring vendors align with industry standards, compliance requirements, SLAs, and KPIs.

- Third party risk management solutions provide technology enablement to drive value from your vendor network and supply chain – ensuring compliance, profitability, and resilience in your TPRM program.

- TPRM platforms automate third-party risk assessments – ensuring timely results that can be easily reported on.

- Third party risk platforms improve accountability and automate risk mitigation plans to continuously monitor third-party performance and lower risk levels.

- Third-party risk management solutions minimise the impact of supply chain disruptions and ensure regulatory compliance across your vendor landscape.

AI is increasingly used in third-party risk management solutions to enhance the accuracy and efficiency of risk assessments. Machine learning algorithms analyze vast amounts of data from third-party sources, such as financial reports, compliance records, and news articles, to identify patterns and predict potential risks. This enables AI-driven solutions to provide real-time risk assessments and insights, flagging potential issues before they become significant problems. AI also automates the process of monitoring third-party activities, continuously scanning for changes in risk factors such as financial instability or regulatory non-compliance.

AI can also be used to guide decision-making by offering predictive analytics and risk scoring models that can assess the likelihood of adverse events. By leveraging natural language processing (NLP), AI can sift through unstructured data, like emails and contract terms, to detect potential risks that might be missed by traditional methods. This proactive approach not only streamlines risk management but also provides a deeper understanding of the third-party landscape, allowing organisations to implement more informed and strategic risk mitigation measures.

When selecting a third-party risk management solution, companies should:

- Ensure the third-party risk platform integrates with a third-party risk intelligence provider to get real time updates on supplier risks like, financial problems, IT security incidents, data breaches, regulatory fines, penalties, and data privacy risks.

- Determine how vendor risks will be categorized and rated to ensure a consistent rating system across the organisation.

- Make sure the third-party management platform can be easily customised to align with internal requirements – you will likely want different vendor risk assessment forms and different workflows based on different types of vendors.

- Evaluate if the third-party management software can be customised to address the unique needs and requirements of your organisation.

- Consider whether the tool can scale with your organisation’s evolving risk management and compliance needs, offering additional functionalities like risk management, regulatory compliance, ESG, incident reporting, health & safety, business continuity, and project management.

- Review the data privacy and security features of the solution, including any additional security options available to ensure it meets the requirements of your IT team.

- Check for integration capabilities with your existing systems and platforms through APIs to maintain a single source of truth for third-party risk data to support real-time monitoring of vendor data.

- Think about the users of the platform, the types of data they will input, and the reports and metrics they need, including their format and frequency.

- Analyze the pricing model to ensure flexibility based on user numbers and the number of modules, so you only pay for what you need.

- Look for solutions that offer extensive reporting outputs for leadership teams.

- Ensure the third party risk management solution aligns with your internal risk and compliance needs and the risk management processes outlined in ISO 31000 best practices.

The key features of a third-party risk management solution include:

- Opt for vendor risk management tools with comprehensive customisable online risk assessment forms to assess a wide variety of different vendors – with all data feeding directly into the platform – allowing organisations to tailor risk assessments to their specific needs and industry standards for more precise evaluations.

- Select TPRM software with an online vendor library to build a detailed profile for each critical vendor comprising of contract details, cost, key contacts, SLAs, KPIs, and any risk intelligence and corporate research relating to each supplier – including risk assessment results and risk scores.

- Choose vendor risk management software with an online vendor portal – allowing third-party vendors to complete questionnaires, surveys, and risk assessments online – with data flowing straight into the third party risk tool.

- The best third-party risk management software platforms offer API integrations – this allows firms to pull in transactional data relating to supplier performance into the platform to monitor risk levels and adherence to SLAs and KPIs.

- Look for third-party risk management tools that integrate with third-party risk intelligence providers to facilitate the continuous monitoring of suppliers in key areas like financial stability, compliance violations, cyber incidents, fraud, and other headline news that could pose a risk to the organisation.

- Look for third-party risk management companies that offer platforms with robust reporting and analytics – a good third-party risk solution will provide detailed insights and analytics on risk exposure in the form of dashboards and reports – enabling informed decision-making and facilitating compliance with regulatory requirements.

- Look for third party management solutions that offer workflow automation to automate routine tasks like the circulation of risk assessments & surveys and to formalize the process for approvals, escalations and action management – improving efficiency and reducing the likelihood of human error.

- Look for a third-party risk management platform that offers vendor risk scoring to generate risk scores for third parties based on industry benchmarks and standards providing a clear overview of potential risks.

- Ensure the platform you select offers compliance management to ensure that third parties comply with relevant regulations and standards – reducing legal and regulatory risks.

- Look for third party risk management vendors that offer third party incident management to track and manage incidents related to third-party risks, ensuring timely resolution and documentation.

- Look for TPRM solutions that allow you to conduct thorough supplier audits and easily compare vendors and suppliers and the risks they pose.

- Select a third-party risk management solution that has business continuity capabilities allowing the organisation to implement a structured approach for assessing business continuity risk from third parties.

Third-party risk management is essential for organisations to ensure operational continuity, regulatory compliance, and data security. It helps mitigate risks associated with third-party failures that could disrupt operations or lead to legal issues and reputational damage. By proactively managing these risks, organisations can protect their sensitive data, maintain their reputation, and avoid unexpected financial losses, ultimately enhancing their overall resilience and efficiency – maintaining consumer trust.

Get started and request a demo

Fill out our simple form to see the Camms third party risk management solutions in action.