CPS 230 Software

The CPS 230 operational risk management standard requires APRA regulated entities in Australia to effectively manage operational risks, main critical operations throughout disruptions, and manage the risks arising from service providers. Camms software can support organisations to implement structured, best-practice processes to meet CPS 230 requirements.

Operational Risk Management

Implement a best-practice operational risk management program to understand risk exposure and set controls to reduce unwanted risk.

Incident Management

Report actual incidents and near misses as they happen, conduct investigations, determine impact, and monitor cases until closed.

Business Continuity

Prepare for unexpected disruptions and ensure long-term sustainability as part of your wider operational resilience objectives with our leading business continuity software.

Third-party risk management

Implement processes for effective third-party risk management including workflows for third-party risk assessments, vendor benchmarking, and ongoing performance monitoring.

Achieve APRA CPS 230 Compliance with our CPS 230 Software

- Risks

- Controls

- Incidents

- Resilience

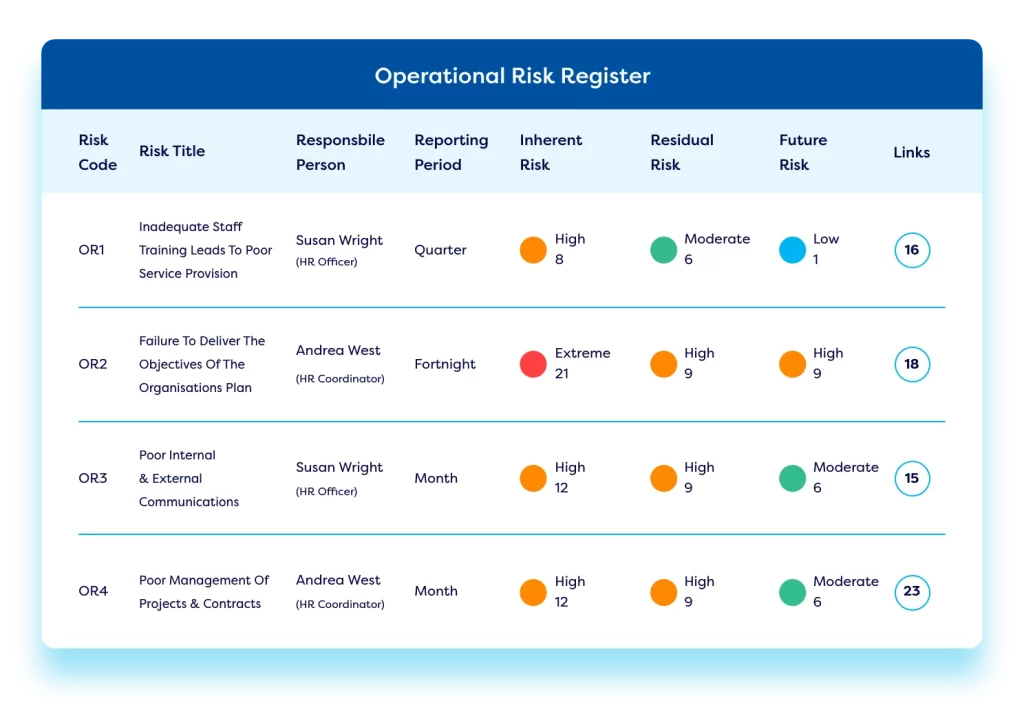

To meet the requirements of the prudential standard CPS 230 operational risk management, firms must maintain a risk management framework. In the Camms GRC platform firms can build an online, digital, searchable risk register, carry out online risk assessments, create a risk appetite framework, and set KRIs to monitor risk levels. Implement workflows to document mitigating actions and easily report on risk across the entire organisation.

To meet the requirements of the new standard, the Camms software for the CPS 230 operational risk management standard enables teams to build a control register, perform control checks, and map controls back to the originating risks to understand risk exposure.

Our APRA CPS 230 platform enables organisations to set up a best practice incident reporting process – enabling incidents to be logged, escalated, and resolved at speed. Comprehensive reporting outputs enable our clients to lower incident rates and map incidents back to the originating risks.

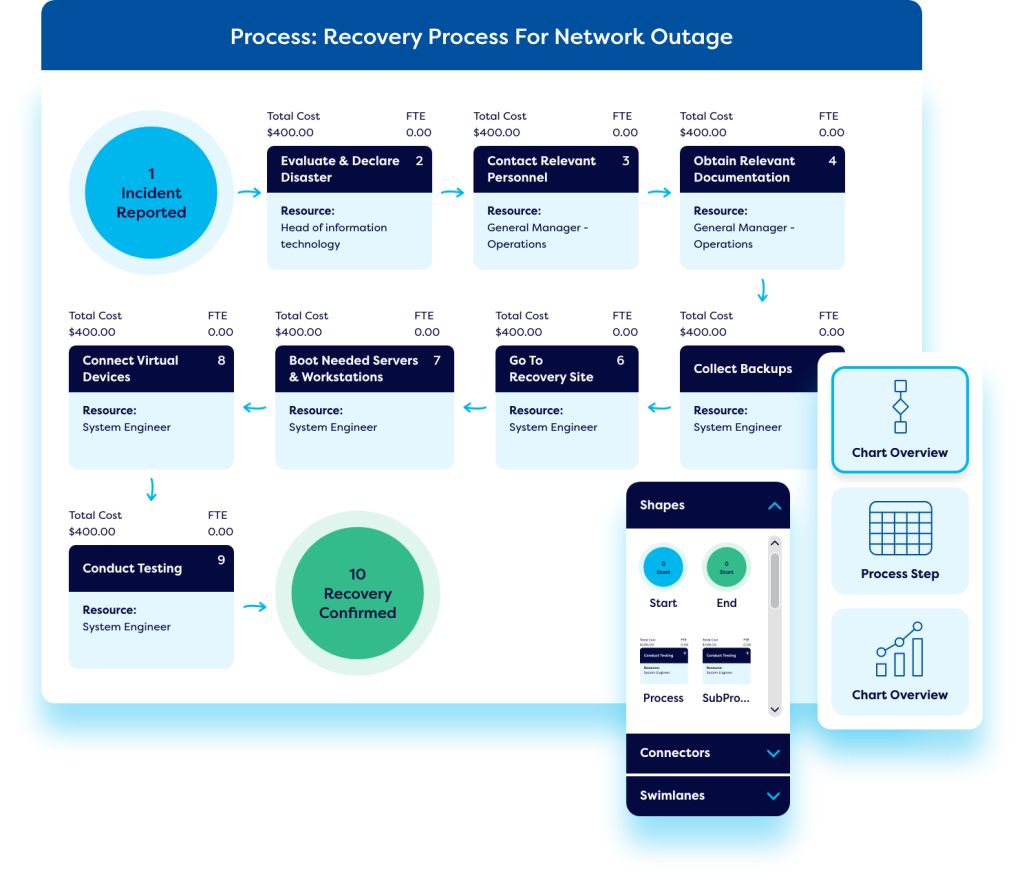

The Camms CPS 230 software enables teams to implement best-practice business continuity plans and ensure long-term operational resilience. The business process modelling capability enables teams to easily understand the impact of events and uncover efficiencies.

CPS 230 software capabilities

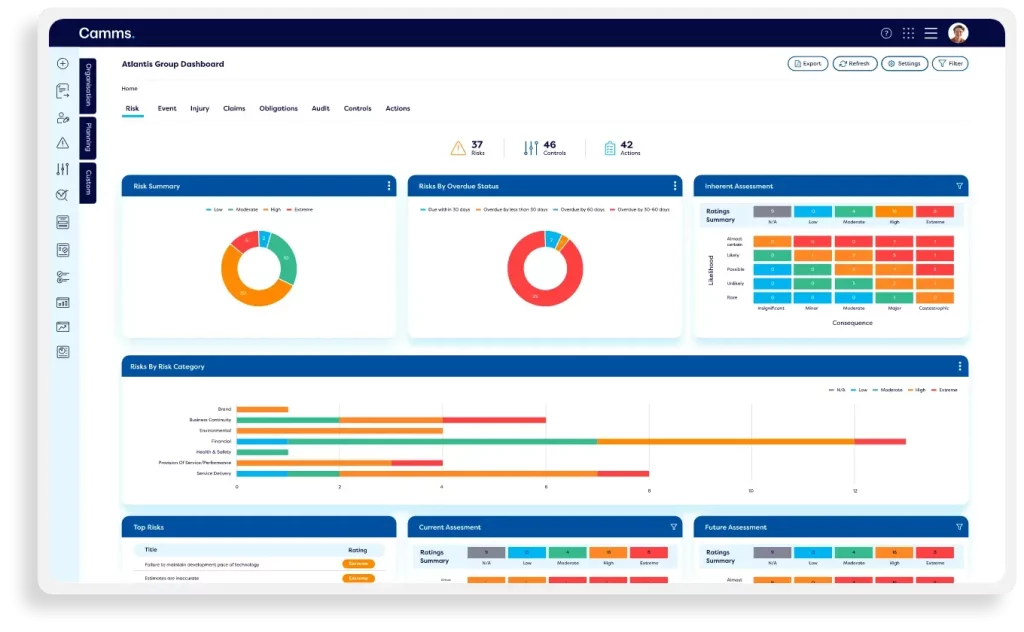

Create a risk register

Build multiple risk registers within our CPS 230 operational risk management platform and categorize and rate each risk according to its impact and likelihood. Risk teams can build unlimited risk registers, with many risk types, and categories, including cyber risk management, vendor risk management, third-party risk management, and project risk management and easily align risk to strategic objectives to establish a complete Enterprise Risk Management (ERM) program.

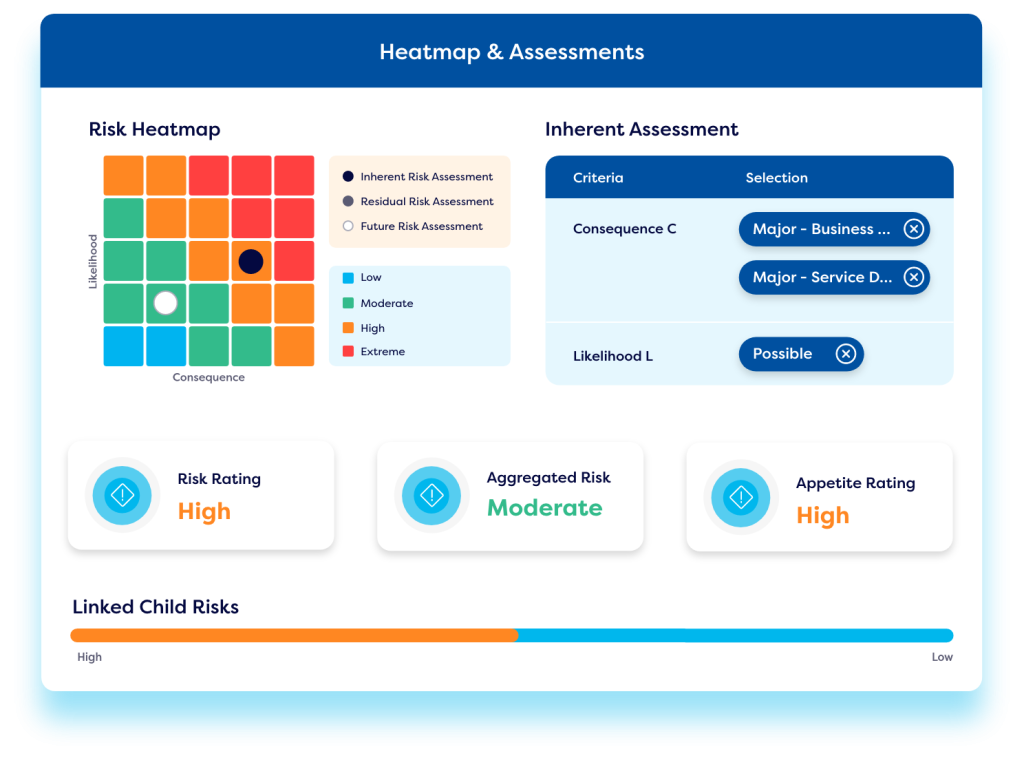

Build a risk appetite

Our CPS 230 software capabilities enable firms to define Key Risk Indicators (KRIs) and link them to their risk appetite – to ensure risk levels remain within tolerated levels.

Build a control library

To achieve CPS 230 operational risk management compliance, the Camms platform provides a best-practice framework for companies to set controls and manage risk in line with CPS 230 requirements. Controls can be linked to any corresponding risks in the risk register.

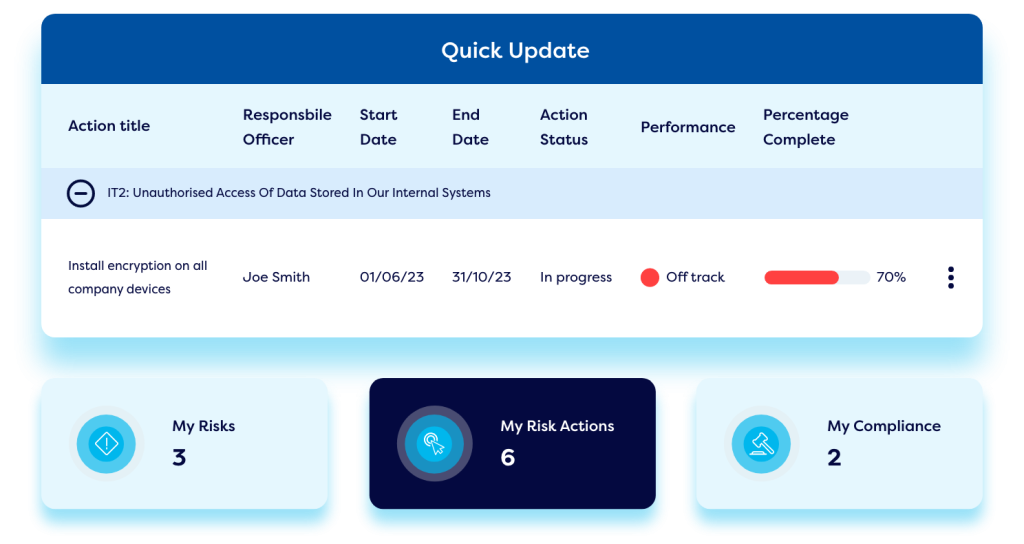

Establish risk treatment plans

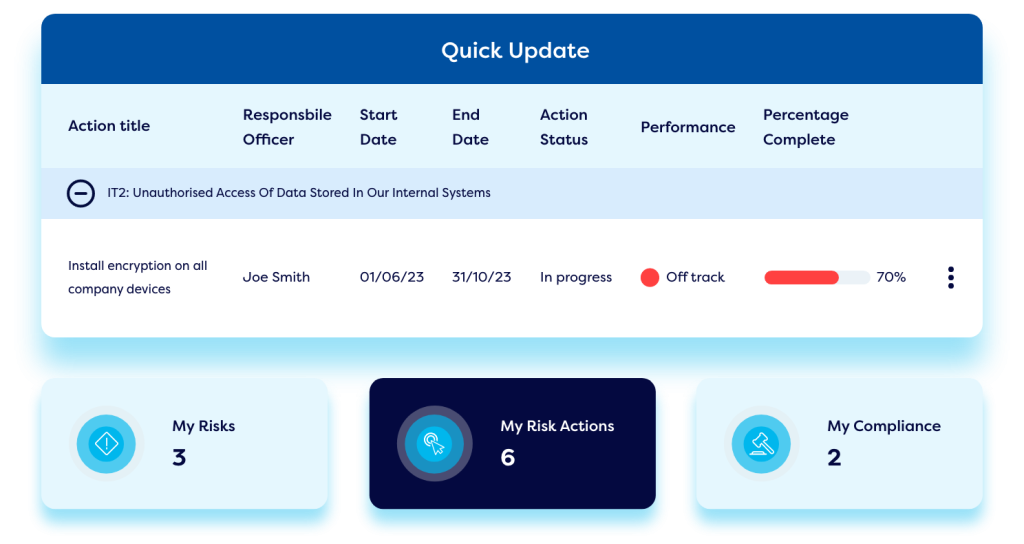

To align with APRA CPS 230 requirements, firms can use the software to implement automated workflows to build detailed risk treatment plans. Responsible staff receive automated notifications and can access best-practice risk treatment plan workflows to lower risk levels quickly.

Evaluate risk

Our CPS 230 compatible software will provide a detailed overview of risk exposure via a series of dashboards & reports – which can be tailored to meet the needs of each individual user due to a pre-defined permissions hierarchy. Lower-level workers can use the software to complete risk assessments and control checks online, while executives and leaders can view top level dashboards & reports on risk levels and risk posture.

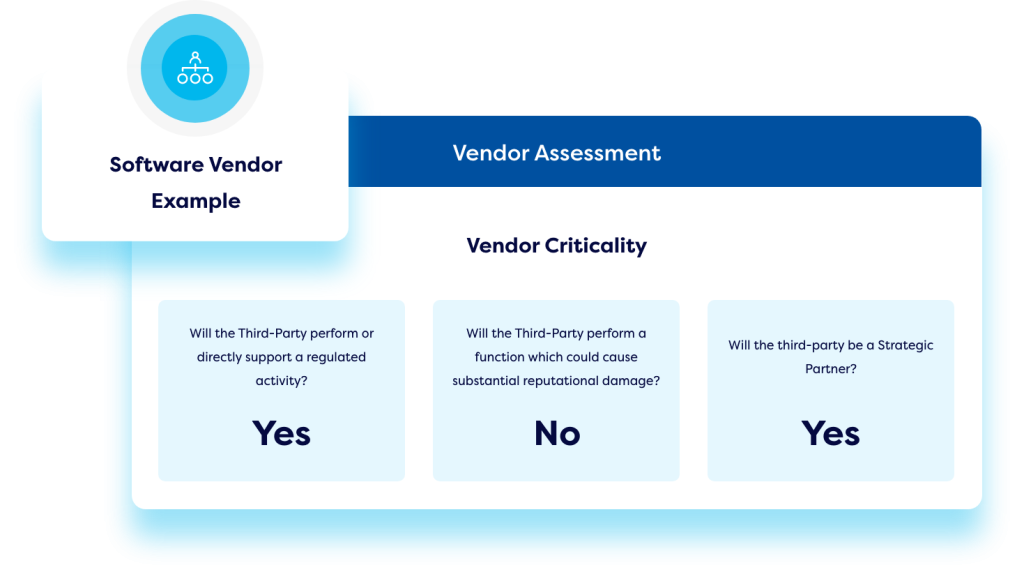

Third-Party Risk Management

Implement a best-practice third party risk management process to effectively manage the risks and contractual arrangements associated with service providers. Build a vendor library capturing critical data around contract details, SLAs and KPIs, and monitor ongoing performance against key metrics. Staff, vendors, and suppliers can easily complete questionnaires, surveys, and vendor risk assessments online via our vendor portal. Easily report on vendor performance and third-party risks via a series of dashboards and reports. Link to third-party risk intelligence providers via API integrations to understand vendor risk in terms of financial stability, ethical standpoint, legal & regulatory convictions, and cybersecurity posture.

Comply with CPS 230 and other standards, regulations, and policies

Firms can use the Camms platform to manage the regulatory requirements of CPS 230. Organisations can set up an obligations library and include any applicable regulations (like CPS 230 and ISO 31000) and any internal policies and monitor compliance by implementing step-by-step workflow processes and checks. Teams can receive notifications of pending regulatory updates and implement a best-practice regulatory change management process. The tool can also be used to establish a policy library and manage policy changes, approvals, signoffs, and attestations. Firms can also plan and schedule any internal and external audits within the platform (including your APRA CPS 230 audit) and capture and findings any recommendations.

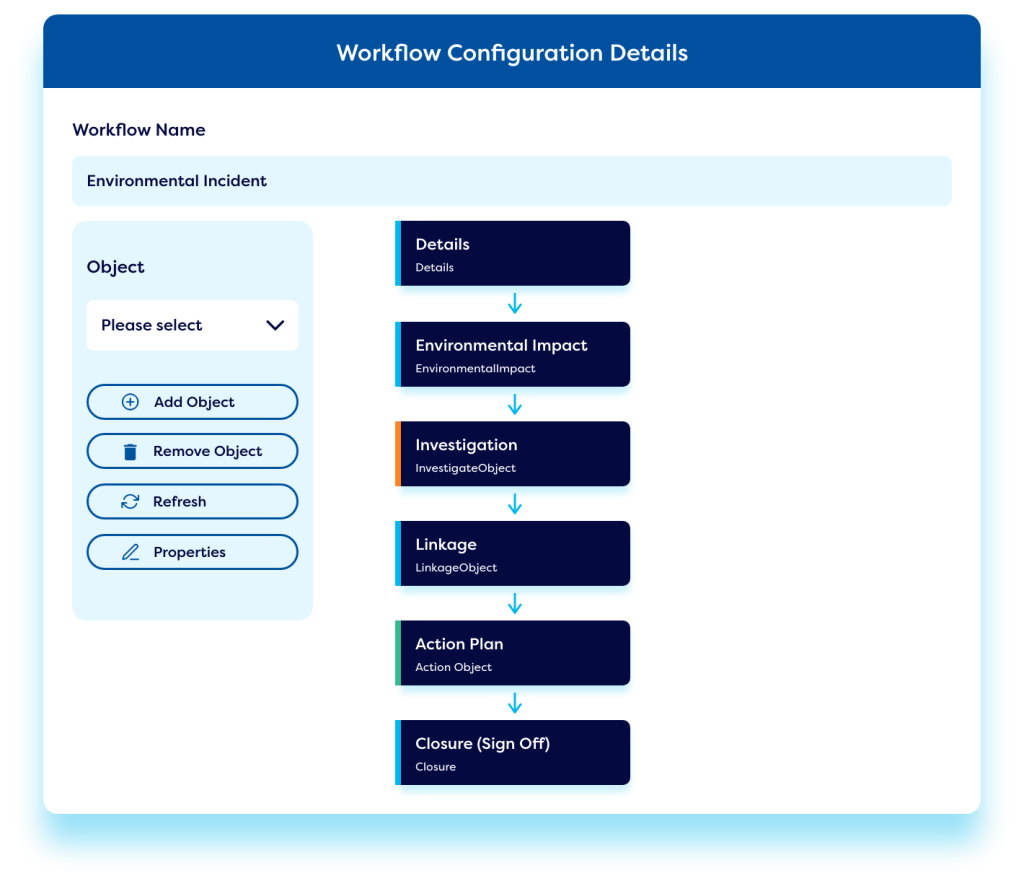

Manage & resolve incidents

To align with the new CPS 230 operational risk standard the Camms software includes best-practice incident reporting capabilities to support organisations to maintain critical operations and reduce risk throughout disruptions in alignment with CPS 230 requirements. This functionality enables operational risk incidents, hazards, and near misses to be captured, escalated, and resolved quickly. Controls can easily be implemented to lower incident rates, and risks can be linked to any related incidents to ascertain the likely cause using root-cause analysis techniques.

Implement business continuity plans

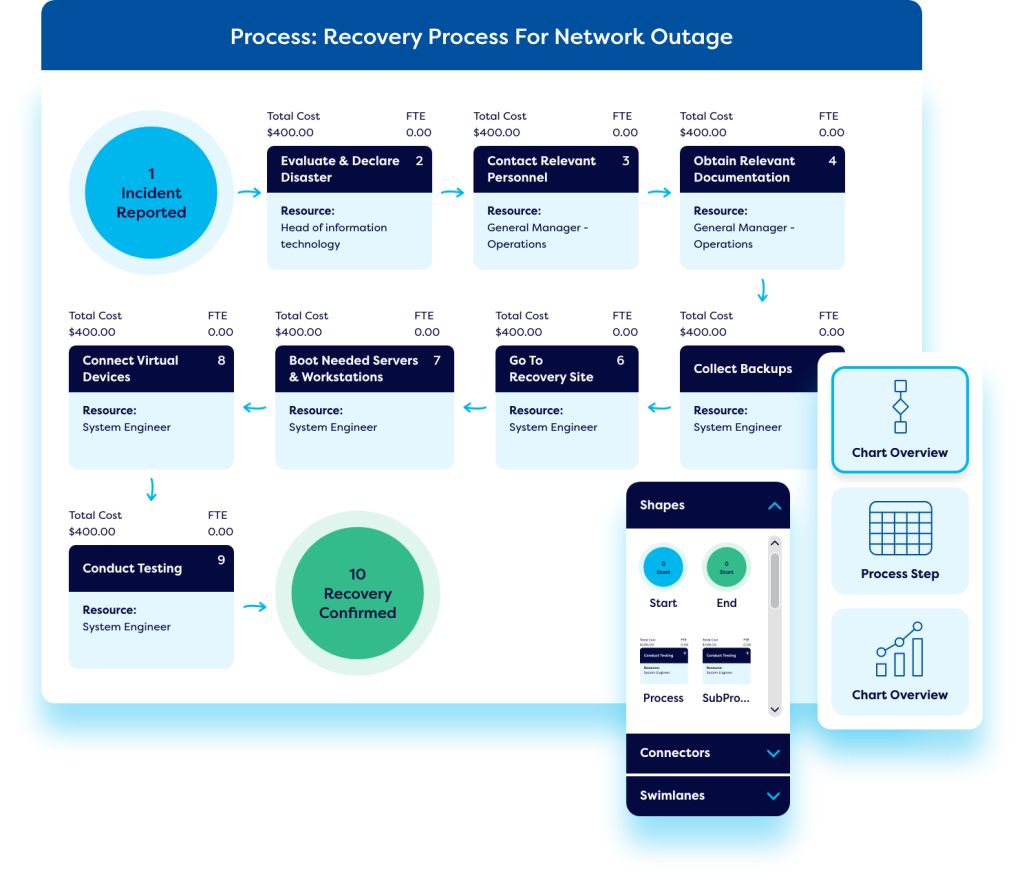

To meet CPS 230 requirements firms must have ample business continuity planning and be able to resume business operations in a crisis. The business continuity Management (BCM) capabilities in our CPS 230 platform enables firms to identify business critical processes and create BCM plans, conduct online Business Impact Assessments (BIAs), carry out business process modelling, activate BCM plans based on the types of incidents logged, and monitor the status of recovery operations.

Why choose Camms' software to manage CPS 230 requirements?

Quick implementation

Our CPS 230 compatible solutions are deployed fast to help you achieve compliance with APRA CPS 230 requirements. Our go live time can be as quick as 8 weeks for standard implementations.

Data security & privacy

The Camms CPS 230 platform is highly secure and certified to cyber security standards including SOC Type 1&2, ISO 27001, and Cyber Essentials. Our CPS 230 platform offers a structured permissions hierarchy, encryption, and audit trails to protect data privacy and ensure compliance with security requirements.

API integrations

The Camms GRC platform offers complex API integrations to assist firms to achieve compliance with CPS 230 requirements. These API integrations enable firms to integrate risk and operational data from other spreadsheets and data sources directly into the platform – ensuring a single source of truth for risk data across all sites and departments.

Resources relating to CPS 230 Standards

The latest and hottest pieces of content relating to CPS 230 and operational risk to keep you in the loop.

Managing CPS 230 Requirements: A guide for APRA-Regulated Entities and Financial Institutions

To help your organisation operate in line with the new CPS 230 operational risk management standard, Camms have created this useful eBook to guide you

Operational Resilience Unveiled: The Integral Role of Business Continuity Planning in CPS 230

Robust operational resilience strategies are at the core of a successful, sustainable business. To support organisations to emerge stronger in the face of adversity, the

Beyond Recovery: How CPS 230 Empowers Businesses to Thrive Amidst Disruption

Why is CPS 230 so critical? Operational disruptions, whether they stem from internal processes, external events, or digital vulnerabilities, have the potential to disrupt business

Frequently asked questions about

CPS 230

The prudential standard CPS 230 is a new operational risk management standard that is applicable to APRA-regulated entities in Australia. According to the Australian Prudential Regulation Authority it is a step on from the APRA CPS220 Risk Management standard. It has a strong focus on the role of the board and senior management in operational risk management processes.

To operate in line with the requirements of the standard, organisations must

- Identify, assess, and manage its operational risks, with effective internal controls, monitoring, and remediation.

- Be able to continue to deliver its critical operations within pre-defined tolerance levels through severe disruptions, with a credible business continuity plan (BCP).

- Effectively manage the risks associated with material service providers, third parties, and vendors, with a comprehensive service provider management policy, formal agreements, and robust monitoring.

For those wondering when the prudential standard CPS 230 becomes mandatory, firms have until 1 July 2025 to implement the APRA 230 necessary changes. The CPS230 changes are therefore mandatory for an APRA-regulated entity from 1 July 2025. However, the draft CPS 230 standard (CPG 230) was first released on 17 July 2023 giving firms ample time to implement measures to meet the requirements.

The prudential regulation APRA CPS 230 applies to all APRA-related entities in Australia. It includes many organisations in the financial services industry. According to APRA CPS 230 applies to:

- Authorized deposit-taking institutions (ADIs), including foreign ADIs,

and non-operating holding companies authorized under the Banking Act (authorized banking NOHCs). - General insurers, including Category C insurers, non-operating holding companies authorized under the Insurance Act (authorised insurance NOHCs) and parent entities of Level 2 insurance groups.

- Life companies, including friendly societies and eligible foreign life

insurance companies (EFLICs), and non-operating holding companies registered under the Life Insurance Act (registered life NOHCs).

It is important for financial services firms to comply with APRA CPS 230 because many financial services firms in Australia are APRA-regulated making the new CPS 230 requirements mandatory for many financial services organisations.

There are several processes that organisations need to implement to meet CPS 230 APRA requirements and ensure unified observability. These include:

- Implementing a best-practice risk management program.

- Formalizing an incident reporting process that enables incidents to be logged and resolved quickly to minimise disruptions.

- Have robust business continuity and perform regular business impact assessments and disaster recovery testing to ensure they can recover from disruptions quickly.

- Establish a best-practice third-party risk management program to manage the risk associated with vendors and suppliers, this includes carrying out regular vendor risk assessments, benchmarking, and score-carding, and monitoring vendor performance against SLAs and KPIs.

The key features of CPS 230 software include:

- Automated workflows and notifications

- Online customisable forms

- Searchable registers

- Dashboards and reports

- API integrations with other systems and data sources

- Best-practice compliance templates

- Integrations with third-party risk intelligence providers

The key features of APRA aligned CPS 230 software include:

- Enterprise Risk Management (ERM)

- Controls and control testing and monitoring

- Third-Party risk management

- Business continuity

- Operational resilience

- Regulatory compliance and regulatory change

- Incident management

Organisations should:

- Implement a best-practice ERM program to identify, assess and manage its operational risks, with effective internal controls, monitoring, and remediation.

- Implement credible business continuity plans (BCPs) to continue to deliver critical operations within defined tolerance levels.

- Implement a third-party risk management program to effectively manage the risks associated with service providers including a service provider management policy, formal agreements, and robust monitoring.

Organisations can ensure compliance with CPS 230 operational risk management requirements by implementing a best-practice ERM program using GRC software. This will enable firms to set up an online risk register and assign ownership for risk. Roll out online risk assessment forms using automated workflows to easily monitor risk levels. Set Key Risk Indicators (KRIs) and define a risk appetite and operate within the agreed levels. Set controls to reduce unwanted risk and perform control testing to ensure controls are effective.

A. Firms should set up a best-practice third-party risk management program using CPS 230 compliant GRC software. The solution will enable you to build a comprehensive vendor register capturing key details around vendor contracts, costs, key contacts, SLAs, and KPIs. You can easily monitor supplier performance, perform benchmarking & score carding using integrations with risk intelligence providers, and carry out regular online vendor risk assessments via an online vendor portal that captures all data centrally. The real-time dashboards and reports will build a complete picture of your vendor risk exposure.

According to CPS 230 firms must have a credible business continuity plan and be able to continue to deliver critical operations within agreed tolerance levels through severe disruptions. To demonstrate this, firms should look to implement a Business Continuity software platform that aligns with CPS230 requirements. The platform should enable firms to identify business critical processes and build a business process register. Regular Business Impact Assessments (BIAs) should be carried out to understand the impact of unexpected events and how they will be resolved and in what timeframe. Firms should identify RTOs, RPOs, WRTs and MTDs and put plans in place to achieve these objectives. Tools that offer business process modelling will help to demonstrate requirements by making it easy to understand the impact of unforeseen events in terms of costs, man hours and lost revenue. Process modelling functionality can also be used to support continuous improvement efforts. Look for BCM platforms that trigger BCM plans based incidents logged and send mass notifications to instigate BCM plans and track recovery progress. The solutions should also allow you to perform scenario and vulnerability testing and disaster recovery exercises.

When selecting a CPS 230 compatible software platform to meet the regulatory requirements of CPS 230, leaders must consider:

- Does the platform offer sufficient capabilities to manage CPS 230 APRA requirements? – Look for a platform that offers operational risk management, ERM, business continuity, incident management, third-party risk management and other supporting functionality such as compliance and audit capabilities out-of-the-box.

- Can the risk & compliance platform be implemented in a way that meets the specific requirements of your organisation?

- Can the operational risk management capabilities scale with your firm as your needs expand and your GRC program matures – look for solutions that enable you to align risk management with strategic objectives and enterprise performance.

- What data privacy protocols & security features does the CPS 230 tool offer as standard, and does it align with your IT requirements?

- Does the CPS 230 compatible software link to your other internal applications and systems via APIs to pull relevant data into the platform to ensure a single source of truth for risk data and reducing data input errors?

The benefits of using GRC software to manage CPS 230 requirements include:

- A reduction in time spent on risk reporting, data aggregation, and administration tasks.

- Risk and compliance platforms provide a centralised view of risk across the entire enterprise supporting you to improve operational performance.

- Governance, Risk & compliance solutions enable the entire organisation to understand CPS 230 requirements and actively participate in complying with the guidelines – completing risk related tasks and logging and resolving incidents as part of their daily role. This creates ample risk data to inform business decision-making and provide proof of CPS 230 compliance.

- Governance, risk & compliance solutions generate better visibility of an organisations operational risk profile and many offer enterprise risk management, cyber risk management, project risk management, and supply chain & third-party risk management in the same platform.

- CPS 230 enabled GRC platforms reduce the costs associated with risk monitoring and operational risk reporting.

- CPS 230 compatible software platforms improve an organisations risk management approach, by facilitating crucial links between risk management, strategic objectives, vendor risk, incidents, and enterprise performance.

- GRC solutions support firms to carry out adequate due diligence to provide proof of CPS 230 compliance to regulators.

- Poor quality risk data due to a lack of data governance & data entry errors.

- Capturing risk and incident data across various forms and spreadsheets creates data input problems like copy & paste errors, over written data, and incomplete fields.

- Disparate risk and incident data held in dispersed, unintegrated spreadsheets creates poor quality data, and an inconsistent risk framework that results in distorted reporting outputs – causing problems with CPS 230 compliance.

- Relying on manual processes that lack automation slows down risk escalation and remediation, allowing risk to escalate to intolerable levels, leaving companies struggling to meet CPS 230 guidelines.

- Manual ad hoc processes affect compliance with CPS 230 – making it hard for firms to prove they are meeting requirements due to a lack of documented evidence.

- Disjointed processes and siloed data make it difficult to link risks to the relevant controls and incidents, causing gaps in CPS 230 compliance.

- Firms are unable to compare risk & incident data across different sites due to inconsistent risk frameworks and siloed data. This makes it hard to make risk-based decisions and provide proof of CPS 230 compliance across departments and sites.

Get started and request a demo of our CPS 230 enabled GRC software platform

Fill out our simple form to see the Camms’ CPS 230 compatible operational risk and resilience solution in action.