Risk and Compliance Management Software

Find out how the latest risk and compliance management software can support your organisation to take a consolidated, best-practice approach to GRC.

Industry Recognition

Camms’ compliance risk software is recognised by top analysts and highly rated by users. Check out our reviews on sites like Forrester, Capterra, G2, Chartis, and Gartner.

Intuitive User Experience

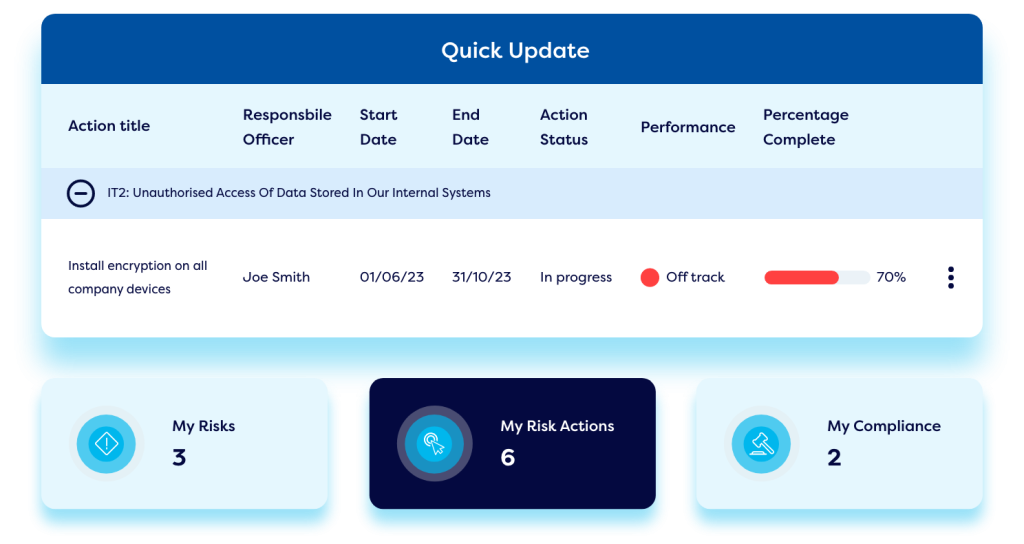

We recently revamped the user interface of our risk management and compliance software – making the user experience more modern and intuitive – enabling staff of all levels to feed into your GRC program.

Rapid Deployment

Our compliance and risk software can be configured and monitored quickly to meet your individual requirements.

Risk and Compliance Software – GRC capabilities to effectively manage risk and become compliant

- Risks

- Controls

- Incidents

- Compliance

Use our software to create an online, searchable risk register, enable staff to carry out risk assessments using online forms, establish a risk appetite and operate within it, set Key Risk Indicators, and monitor risk levels. Implement risk mitigation workflows and create reports on risk across the entire enterprise at the touch of a button.

Our software enables teams to build a control register, carry out control checks, and map controls back to the originating risks to understand risk levels and control effectiveness.

Our compliance risk management software enables teams to implement a best-practice incident reporting process – ensuring incidents are logged, escalated and resolved in a short time frame. In depth incident reports enable companies to reduce the number of incidents and map incidents back to the originating risks.

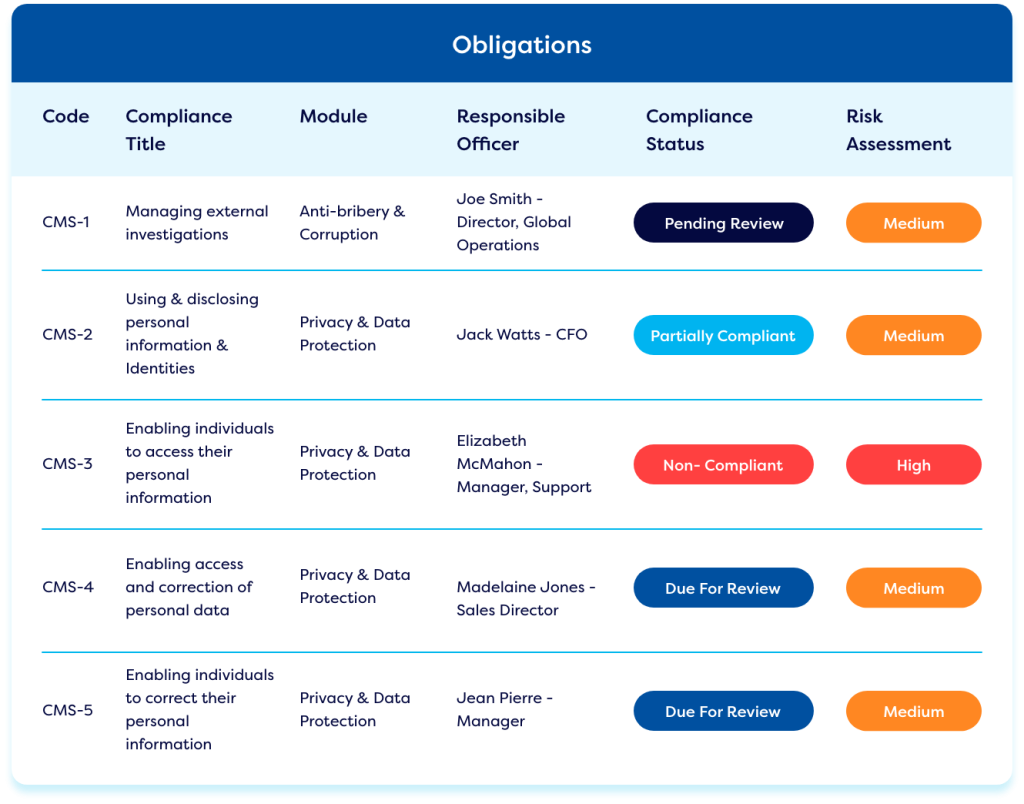

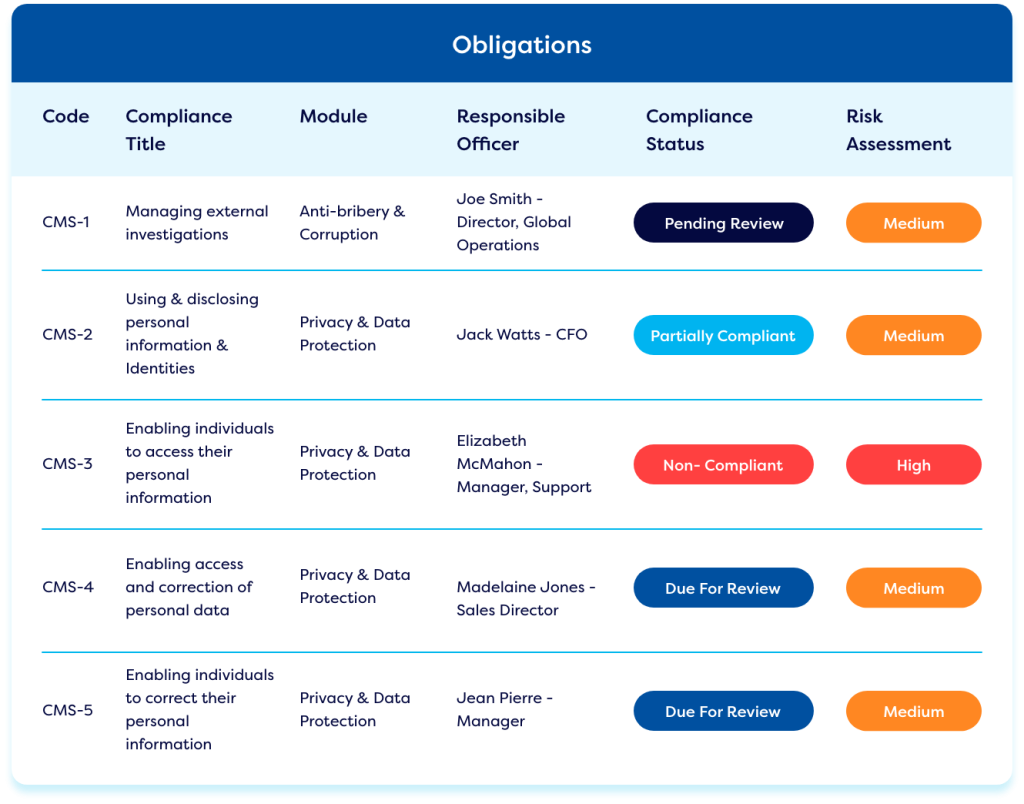

Use the out-of the-box frameworks available in our compliance management software to build a digital obligations library and streamline compliance tracking and monitoring efforts. Compliance monitoring can be measured against relevant obligations, manage regulatory change, house an up-to-date library of policies, and collect employee compliance attestations – all in one platform.

How does risk and compliance management software work?

Create a Risk Register

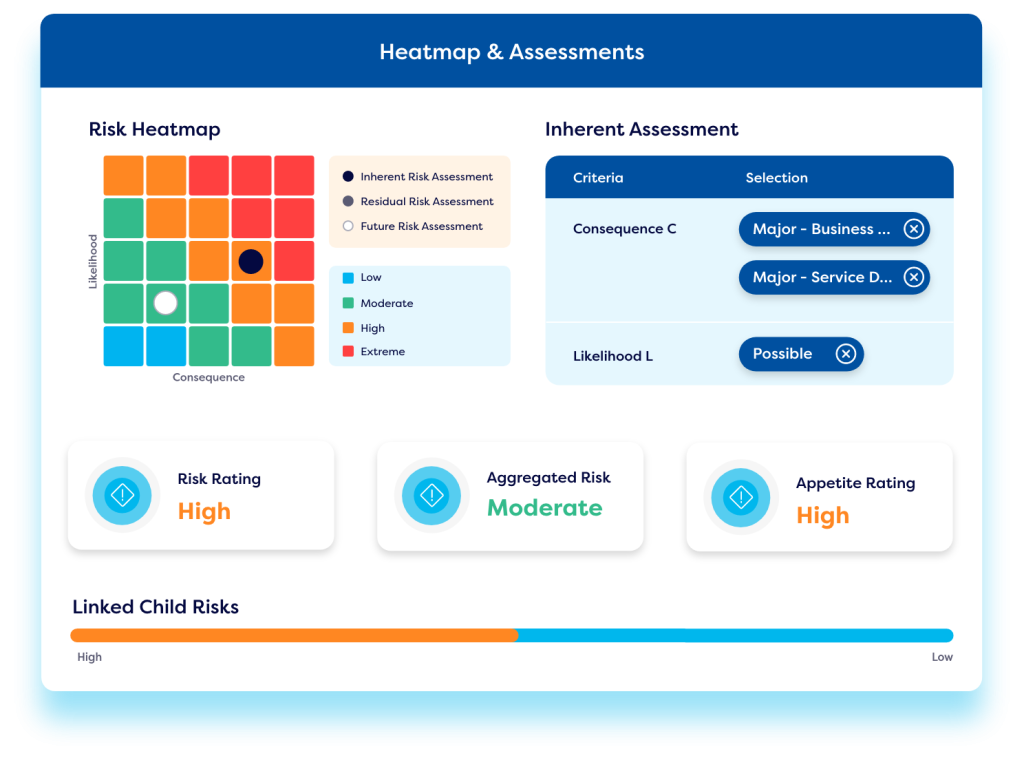

Create multiple risk registers using best-practice templates. Categorise and rate every risk according to its likelihood and anticipated impact. Camms offers unlimited risk registers with numerous risk types and categories, including cyber risk management, vendor risk management, third-party risk management and project risk management.

Build a Risk Appetite

Our legal risk management software enables firms to establish Key Risk Indicators (KRIs) and align them with their risk appetite to ensure risk levels remain within the agreed boundaries.

Build a Control Library

Our compliance and risk management software offers a best-practice framework for organisations to manage controls and risks in line with widely adopted regulatory frameworks including COSO, ISO 31000, and SOX. Controls can be linked back to multiple risks in the risk register.

Establish Risk Treatment Plans

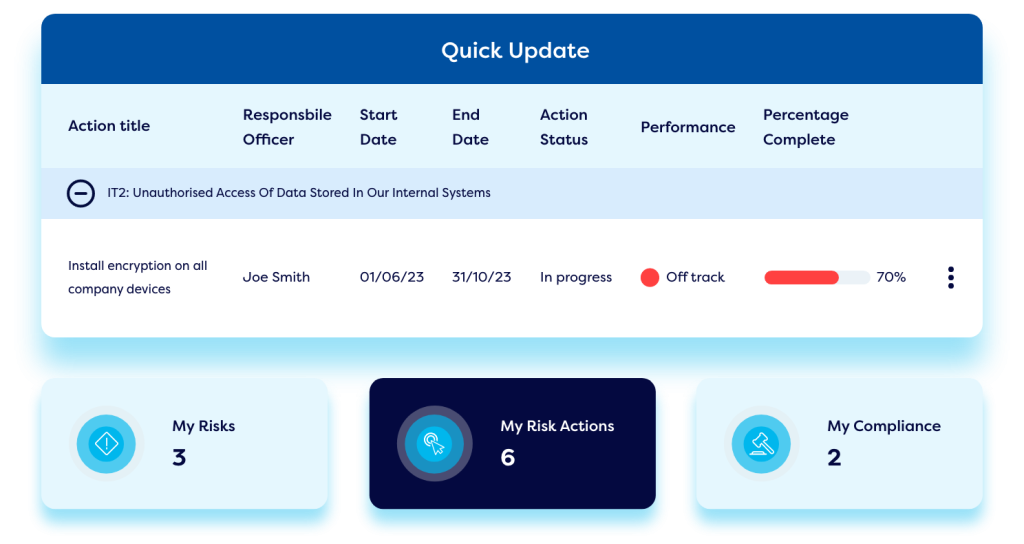

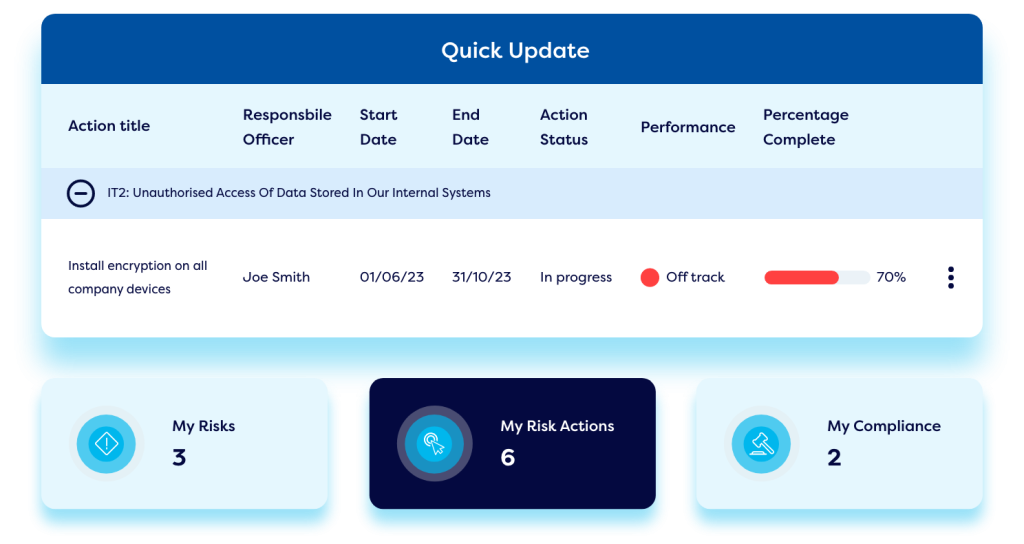

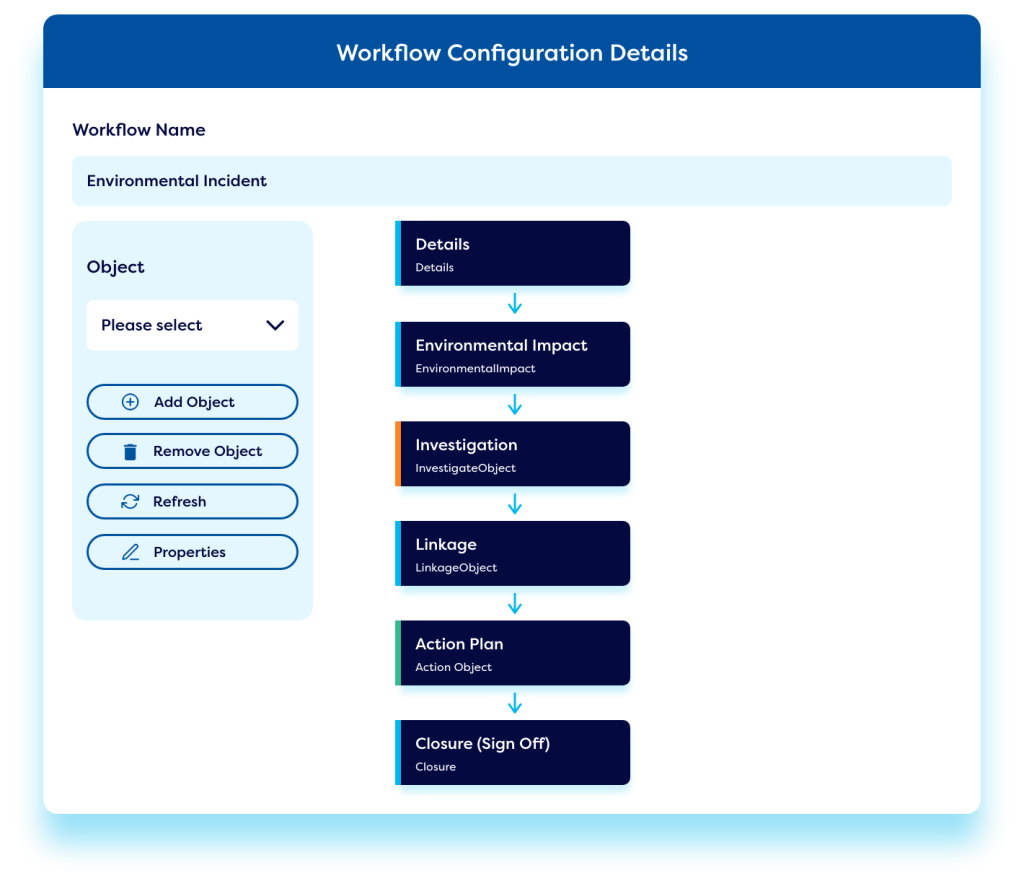

Our solution enables firms to build automated workflows to formulate detailed risk treatment plans. Stakeholders will receive automated notifications so they can understand risk exposure and act to lower risk levels quickly.

Evaluate Risk

Our software provides a detailed overview of risk exposure using a wide variety of dashboards and real-time reports – which can easily be configured to meet the compliance requirements of each staff members role and responsibilities thanks to a pre-established permissions hierarchy.

Lower-level workers can use our risk and compliance platform to fill out assessments and control checks online, while executives and board members can view enterprise-wide dashboards and reports on risk levels and risk status to ensure long-term sustainability.

Maintain Compliance with Regulations, Legislation, and Internal Policies and Procedures

Manage your legal requirements by establishing an online obligations library of relevant regulations, standards, mandatory obligations, and policies.

Receive alerts of pending regulatory changes straight into the compliance management system via integrations with third-party content providers. Use pre-defined workflows to facilitate a best-practice regulatory change management process to ensure regulatory compliance. Manage your library of policies online to understand live and aging policies and facilitate the creation, approval, sign off, circulation, and attestation of policies – ensuring effective regulatory compliance management.

Manage & Resolve Incidents

Camms software enables firms to establish best-practice incident reporting capabilities. Staff can log incidents, hazards, and near misses online and automated workflows ensure incidents are escalated and resolved in a timely manner. Controls can easily be established and linked back to the relevant incidents to keep incident rates within tolerable levels. Incidents can be mapped to any related risks to understand the cause using root-cause analysis techniques.

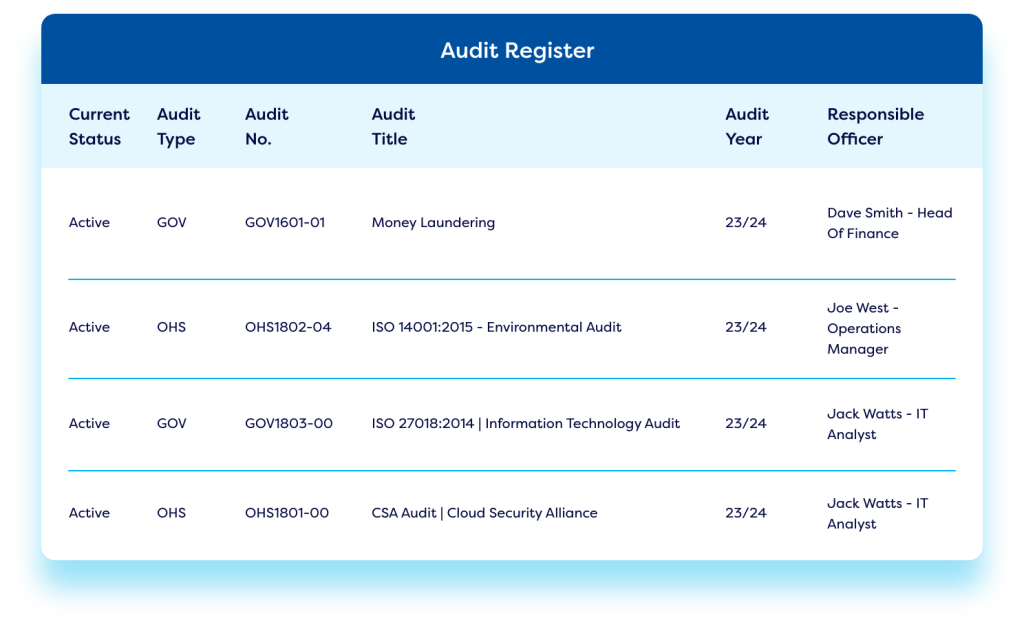

Streamline External & Internal Audits

Use our compliance management software tool to plan, scope, and schedule your internal and external audits – creating digital forms for staff to log key actions and checks. Use automated workflows and online forms to brief teams and capture audit findings. Report on audit results and view the findings via a series of dashboards and reports. Use automated workflows to implement and document corrective actions.

Why choose risk and compliance management software from Camms?

Built on the latest technology

Our legal risk management software offers a whole host of GRC capabilities built using the latest modern responsive technology, making our tool stable and very secure with screens that load in less than one second.

Data security & privacy

The Camms risk and compliance management software is highly secure and certified to data privacy and security standards including SOC Type 1&2, ISO 27001, and Cyber Essentials. Our integrated GRC management software offers a detailed permissions hierarchy, end to end encryption, and audit trails to protect data privacy and ensure compliance with security requirements.

API integrations

Risk and compliance management software from Camms offers an API integration library – enabling firms to pull risk data from other spreadsheets and data sources into and out of the compliance and risk software – ensuring a single source of truth for risk related data across all sites and departments.

Discover more about the Camms

Risk and Compliance Management Software

Resources relating to Risk and Compliance Management Software

The latest and hottest pieces of content relating to compliance and risk management software solutions to keep you in the loop.

A Simple Guide to Choosing the Right Risk Management Software

This blog will discuss must-have features in risk management software and support you to choose the right platform for your organisation.

10 Steps to Achieve a Best Practice Regulatory Compliance Program

In this eBook, we explore the challenges around manual regulatory change management, we highlight the top 10 regulatory compliance issues, and we provide a step-by-step guide to help you achieve a best practice regulatory compliance program.

From Excel to Excellence: Turning Your Risk Data into Insights & Decisions

In this eBook, we explore why spreadsheets are outdated for risk management and help you to identify if your business is ready to swap spreadsheets for an automated GRC solution. Plus, we detail the top 10 reasons to switch from spreadsheets to software.

Frequently asked questions about

Risk and Compliance Management Software

Risk management and compliance software tools are usually online platforms that enable firms to implement best-practice governance, risk and compliance (GRC) processes. The tools automate risk and streamline risk and compliance processes, cutting out admin and capturing adequate, accurate risk and compliance data – thanks to a variety of data governance rules. The solutions enable firms to build online risk registers and control libraries, conduct risk assessments, and implement workflows and controls to address and reduce the risk. This software can also be used to manage regulatory change, provide compliance assurance, plan & schedule audits, and to manage incidents. Leading risk & compliance management software allows firms to map risk to strategic objectives & enterprise performance to understand how risk & compliance obligations impact business operations and strategic plans. Most GRC software platforms offer a variety of dashboards and reports – enabling firms to get a complete view of risk and investigate problem areas as they delve into the details.

When selecting a compliance risk management software, leaders must consider which staff and departments will need access to the tool and what data and metrics they need to summarise and report on. When scoping out requirements for this kind of software, organisations must consider:

- Are there any regulatory requirements that the organisation must comply with that will affect how the GRC program is structured?

- Does the operational risk management software offer best-practice Operational Risk Management (ORM) and Enterprise Risk Management (ERM) functionality?

- How will you categorise and rate risk and what framework, risk ratings and categorisation will be used to make risk comparable across different areas?

- Can leaders obtain a simple view of compliance status against regulatory obligations and industry standards?

- Can the risk and compliance management software be implemented according to your individual needs and bespoke requirements?

- Can staff easily implement risk and compliance tasks online?

- Can the risk and compliance management solution scale and grow with your organisation as your requirements expand and your risk & compliance program matures?

- What IT security features and data privacy options does the GRC solution offer, and does it align with the requirements of your IT team?

- Does the software integrate with your other internal applications and systems via APIs to pull risk & compliance related data into and out of the platform to ensure a single source of truth for risk – reducing data input errors?

- Which staff and teams will need to use the risk and compliance software – what information will they input and what reports & insights do they need to view and in what format?

- Look for a solution that enables you to build an online obligations library of obligatory requirements, manage regulatory change, scan the regulatory horizon for updates, and monitor compliance – using simple workflows and online forms to carry out compliance checks and attestations.

- Choose software that offers specific solutions around anti-money laundering, conflicts of interest, sanctions checks, gifts & entertainment, whistleblowing, and feedback & complaints.

- Choose a compliance platform that offers templates and frameworks that align with ISO standards.

The benefits of utilising SaaS cloud-based risk and compliance management software include:

- Reduced time spent on risk reporting, data aggregation, and administrative tasks.

- A centralised view of risk exposure and compliance status across the entire organisation.

- Streamlined risk and compliance tasks, ensuring consistent data for informed decision-making and compliance assurance.

- Improved visibility of an organisation’s operational risk profile. Many risk and compliance tools offer Enterprise Risk Management (ERM) capabilities, cyber risk management, project risk management, and supply chain and third-party risk management in the same platform.

- Reduced overheads associated with risk monitoring and risk reporting efforts.

- Improved approach to risk management by enabling critical linkages between risk management, strategy, compliance, and operational performance.

- Adequate due diligence for compliance assurance.

- Easy in-house configuration to reduce implementation and professional services costs.

- Support for multiple risk registers, types, and categories for detailed and holistic reporting.

- Built-in customisable reporting to meet standard and bespoke requirements.

- Seamless integration with existing systems and data sources for consistent risk data.

- Comprehensive governance, risk, and compliance capabilities in a single centralised platform (e.g., incident reporting, regulatory change, audits, and ESG).

- Cyber risk and data protection features, including incident management and compliance with privacy laws.

- Pre-built templates aligned with key regulatory standards.

- Vendor and third-party risk management for supply chain oversight.

- Poor quality GRC data due to a lack of data governance and data entry errors.

- Capturing risk and compliance information across various forms and spreadsheets leads to data entry problems like copy-paste mistakes, overwritten data, and missed fields.

- Siloed risk and compliance data held in unintegrated spreadsheets creates bad quality risk data and an inconsistent risk framework that results in misleading reporting – resulting in poor decision-making.

- Relying on manual processes that lack automation negatively impacts the resolution of risk, causing risk to escalate to unbearable levels.

- Manual disjointed processes also affect compliance with regulations, policies, and procedures – making it tough for firms to prove compliance to regulators.

- Siloed data and a reliance on multiple spreadsheets makes it nearly impossible to link risks to the relevant controls and compliance obligations – making it hard to understand risk exposure and compliance status.

- Companies are unable to compare GRC data across different sites due to inconsistent risk frameworks and siloed data. This makes it tricky to make risk-based decisions and provide an accurate view of compliance status across departments and sites.

Use the Camms online calculator to find out how much you could save in terms of cost and hours spent on managing risk if you were to use risk management software. Enter the necessary details about how you currently manage risk in your company and our useful calculator tool will produce potential figures on the likely time and money you could save by implementing risk and compliance software.

Get started and request a demo of our risk and compliance management software

Fill out our simple form to see the Camms risk and compliance management software in action.