Integrated Risk Management Tool

Understand how the latest integrated risk management tools can help your business seamlessly streamline and automate its risk management processes.

Industry-Rated

Did you know that our integrated risk management (IRM) platform is highly rated by leading analyst and customer review sites like Gartner, G2, Forrester, Capterra and Chartis?

Intuitive User Experience

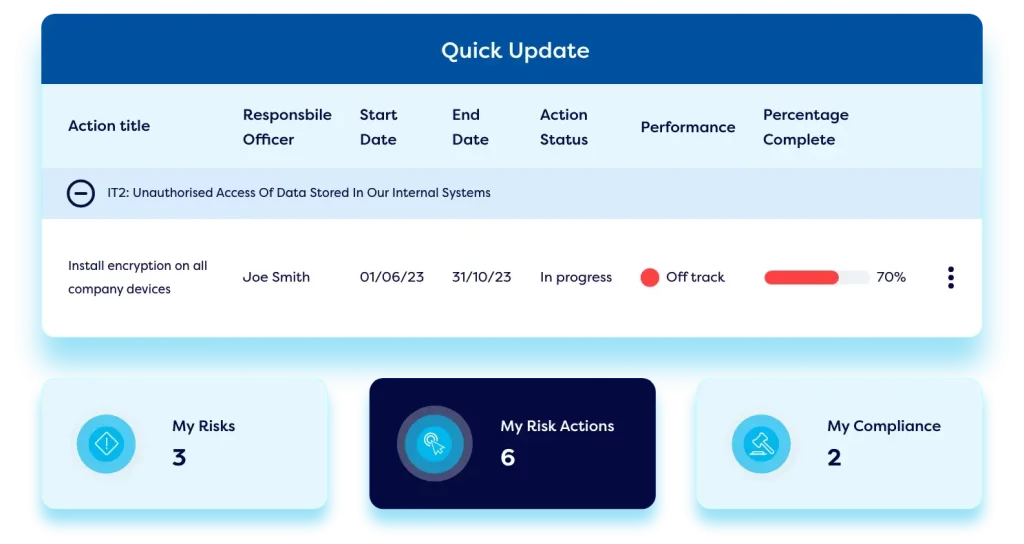

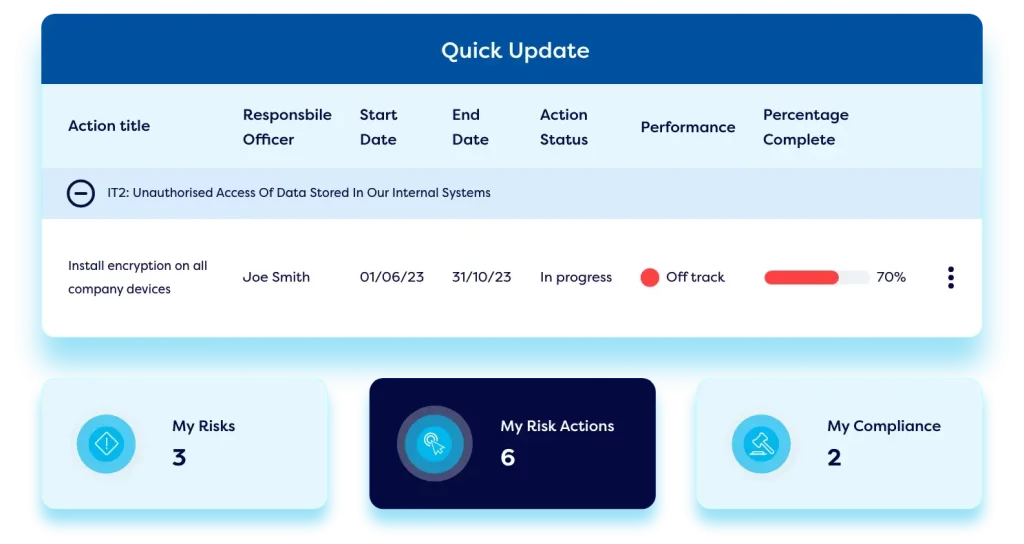

The Camms risk management tool features a modern interface that enables your entire team to feed into your risk management efforts as part of their daily role.

Speedy Deployment

Our solutions are designed to be rapidly deployed and configured to meet any individual requirements of organisations both large and small.

Generate risk intelligence to support decision-making

- Identify

- Monitor

- Report

- Control

Build an online risk register in the IRM software and categorise and rate risk according to your preferred risk framework.

By implementing an integrated risk management platform, teams can easily identify when Key Risk Indicators (KRIs) are reaching an intolerable level and implement necessary changes.

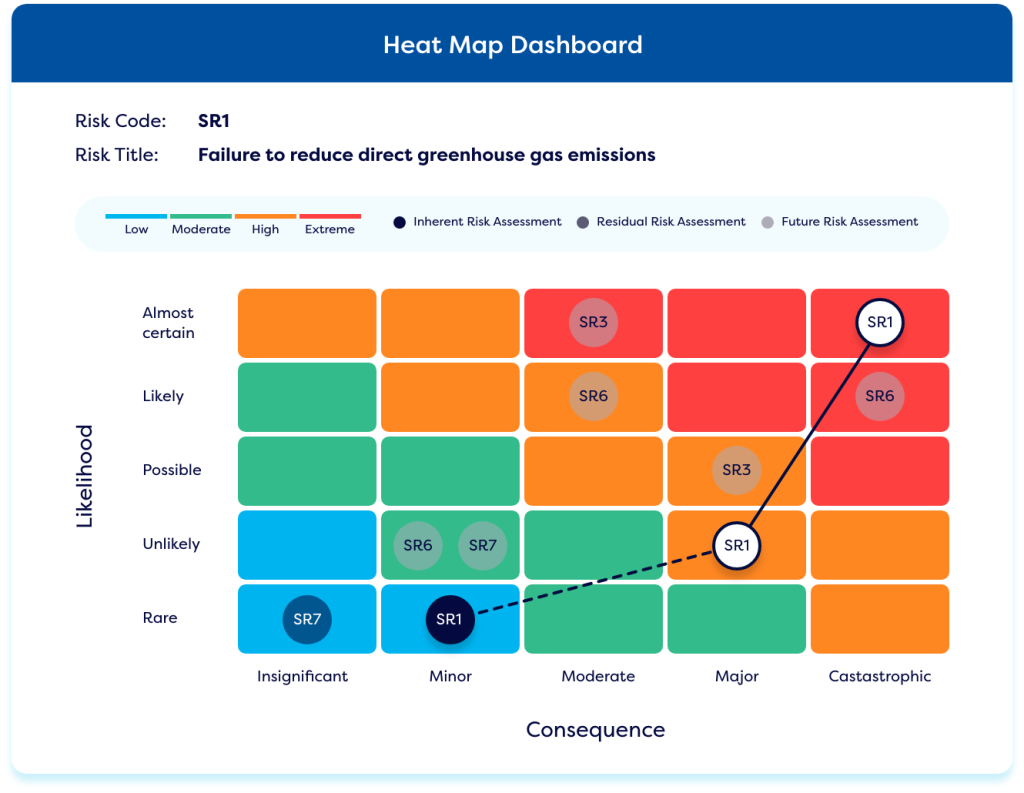

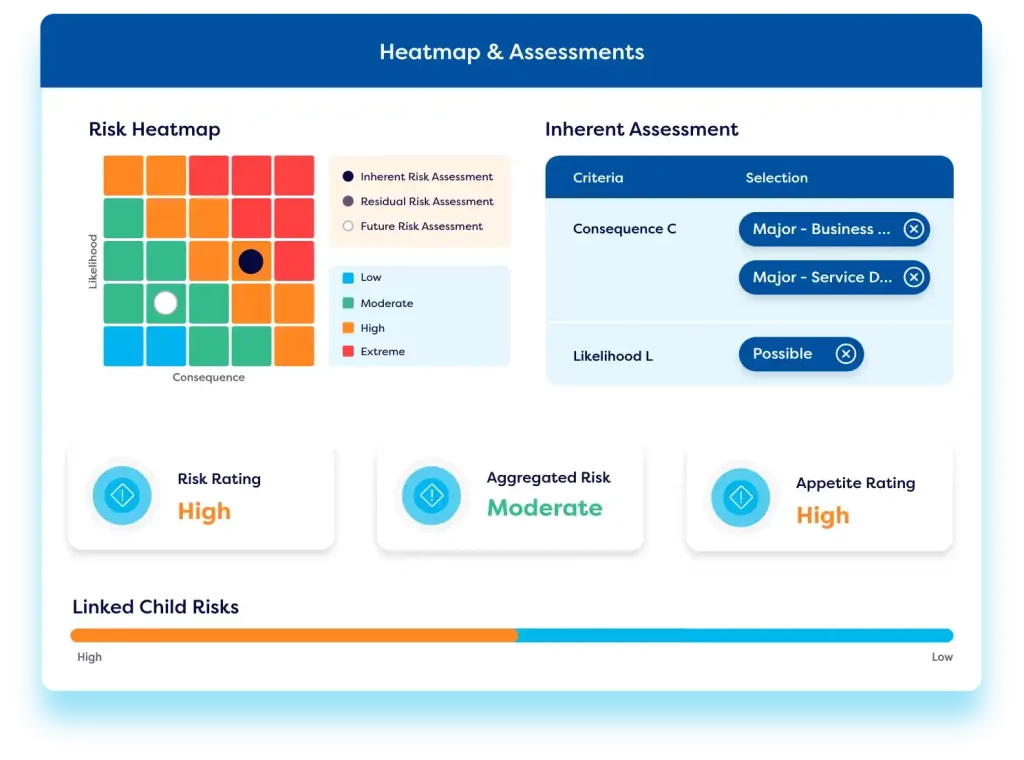

With our IRM application your team can run a variety of risk reports including interactive dashboards, heat maps, and bow-tie visualisations.

The Camms IRM tool is equipped to enable teams to set internal controls and carry out control testing to control risk levels.

How does an integrated risk management tool work?

Build a Risk Register

Create an online risk register within our solution to easily rate and segment risks according to their criticality and type. Our platform offers elevated functionality in comparison to other IRM software vendors.

Teams can easily create infinite risk registers, types, and categories and utiilise our risk management tool to carry out online risk assessments that feed into their risk library.

Monitor Risk & Agree on a Risk Appetite

Our risk management application supports organisations to easily set Key Risk Indicators (KRIs) and define their risk appetite – automated alerts ensure risk levels remain within the desired guidelines.

Build a Comprehensive Control Library

With our tool, organisations can leverage a regulatory compliance management framework to manage risks and controls in line with COSO, ISO 31000, and SOX requirements.

Our operational risk management tool allows teams to map risk to relevant controls to understand risk exposure.

Implement Risk Treatment Plans

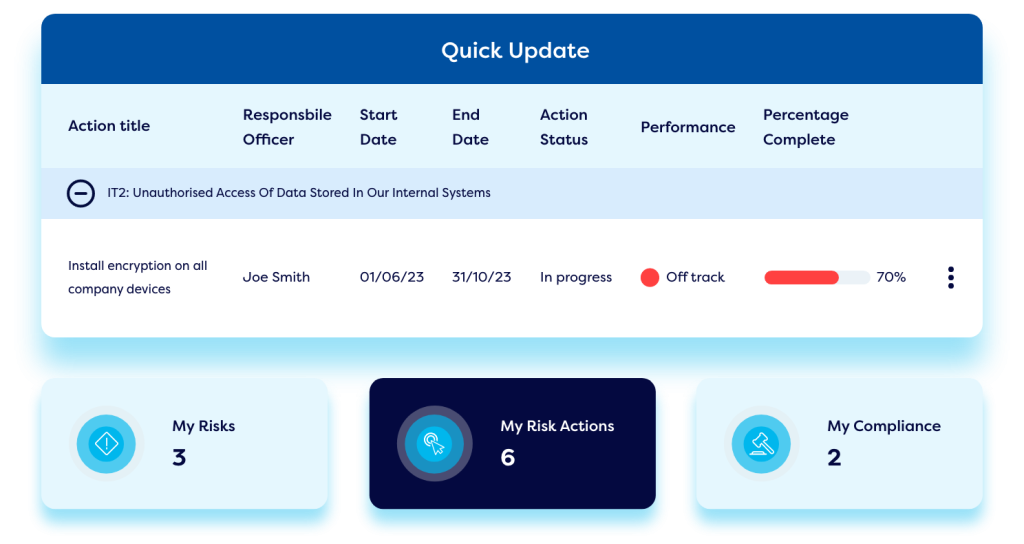

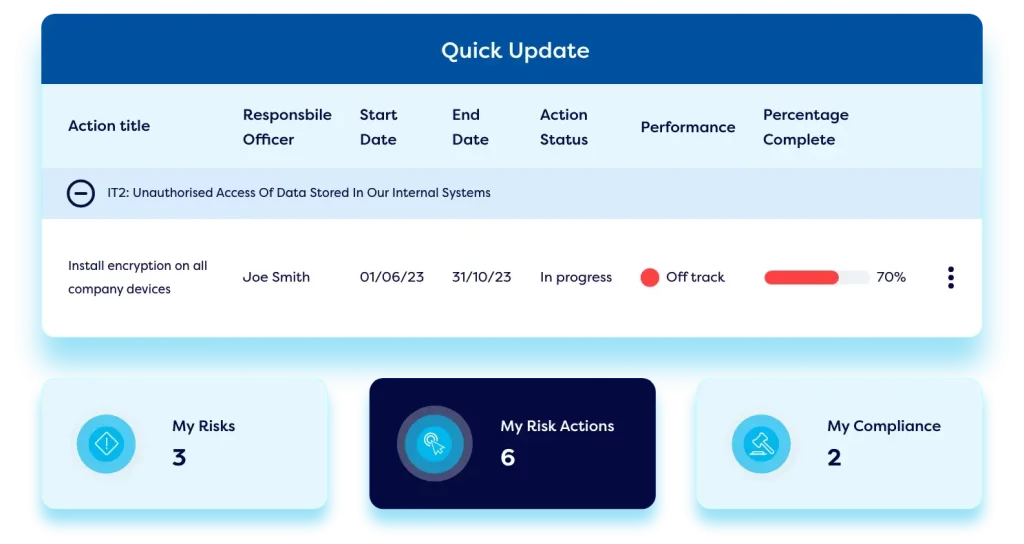

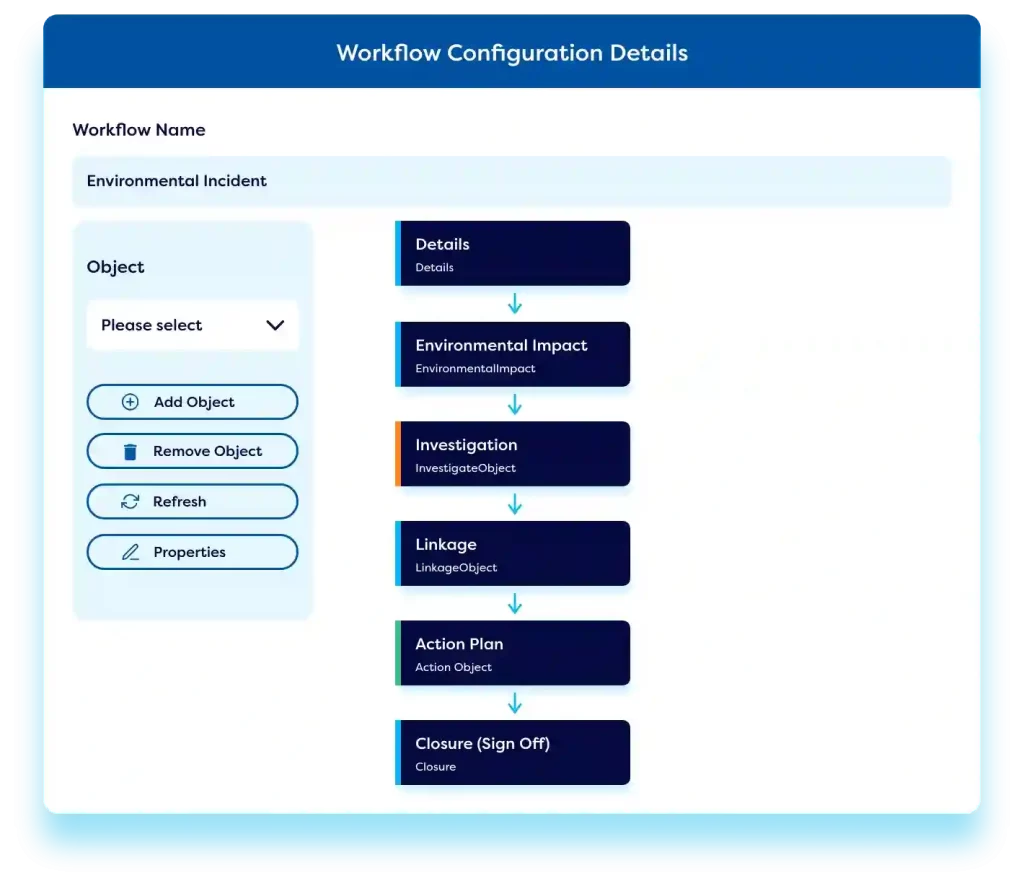

Camms risk management solutions offer templates to easily build detailed and strategic risk treatment plans. Our workflow automation notifies relevant risk owners and facilitates a step-by-step process to address, respond to, and mitigate risk.

Evaluate Risk

With our best in class risk management platform teams can access insights into their risk profile via a series of dashboards & reports – personalised to each individual user.

Comprehensive dashboards & reports offer the Board and executives insight into enterprise risk management levels and current risk exposure.

Manage and Reduce Risk Incidents Through to Resolution

Leverage our risk management product for best-practice incident reporting functionality. Easily capture, escalate, and control incidents at a fast pace. The platform enables risks to be linked to related incidents to identify root-causes.

Why choose an Operational Risk Management Tool

from Camms?

Modern user interface

Our leading integrated GRC software features a modern, intuitive user interface – designed to enable staff to effortlessly carry out risk related tasks online.

Data security & privacy

Our solution for risk management provides security assurance and is SOC Type 1&2, ISO 27001, and Cyber Essentials certified. The Camms risk management API integration platform offers role-based audit trails, encryption, and access controls to ensure data privacy and compliance with regulatory requirements.

API integrations

Our risk management API integration platform provides important mapping and flow of data between third-party systems and data sources with a comprehensive API integration library. This enables teams to pull in risk data from other spreadsheets and data sources directly into the tool – ensuring a single source of truth for risk data.

Discover more about our IRM solution

Resources relating to Integrated Risk Management Tools

The latest and most relevant pieces of integrated risk management platform content to keep you in the loop.

A Simple Guide to Choosing the Right Risk Management Software

This blog will discuss must-have features in risk management software and support you to choose the right platform for your organisation.

8 Surefire Ways to Improve Your Risk Management Program

This whitepaper highlights the importance of adequate risk reporting to guide decision-making, identify risk exposure, and uncover control inefficiencies and explains how to get a complete view of risk across your organisation.

From Excel to Excellence: Turning Your Risk Data into Insights & Decisions

In this eBook, we explore why spreadsheets are outdated for risk management and help you to identify if your business is ready to swap spreadsheets for an automated GRC solution. Plus, we detail the top 10 reasons to switch from spreadsheets to software.

Frequently asked questions about

Integrated Risk Management Tools

Integrated Risk Management (IRM) is a comprehensive approach that organisations use to identify, assess, prioritise, and manage risks across all aspects of their operations. It involves integrating techniques into various functions and levels of an organisation to create a unified risk management procedure.

This software is designed to facilitate the implementation of the IRM process by providing a centralised platform for all employees to feed into the risk management program and carry out risk related tasks and actions – creating invaluable risk insights for teams and the board.

When selecting a software vendor, firms must think about which staff and teams will be using the tool and what data outputs they need to extract.

When scoping out requirements for risk management, firms must consider:

- If there any risk-related regulations that you must comply with that will affect how you structure your integrated risk management plan?

- Which IRM framework will you use to rate and categorise risk.

- If the tool can be customised to meet any bespoke company requirements.

- If the tool offers further functionality to grow with you as your organisation expands

- What information security and data protection measures the tool has.

- Whether the platform links to your other systems and data sources via API Integrations to ensure a single source of truth for risk data.

- Who needs to access the application and what data they’ll input and what data they need to view and report on from the tool.

The benefits of integrated risk management include:

- Less time spent on risk management reporting and administrative tasks and more time spent on risk mitigation and corrective actions.

- A holistic view of the organisation’s risk.

- Enterprise-wide integration into risk management processes, enabling the generation of risk data to support data-driven decision-making as part of everyday operations.

- Better visibility of an organisation’s risk profile – providing a consolidated view of exposure.

- Reduction in risk monitoring and reporting costs.

- An enhanced risk management approach that enables companies to link risk management to strategic objectives and enterprise performance.

- A stronger risk-aware culture as all employees can interact with the risk management plan as part of their daily role through simple tasks like risk assessments, questionnaires, surveys, and checks. This data provides a complete picture of risk exposure for leadership teams.

- A risk management strategy with their organisational strategy to enable them to take risks that will help to achieve their strategic goals.

- Easy in-house configurability to eliminate expensive external configuration costs.

- Unlimited risk registers, types, and categories for an effective approach.

- Real-time reports and live dashboards that can be customised to suit any internal bespoke requirements.

- Easy integration with your other systems via APIs to ensure a single source of truth for your risk data for an effective IRM approach.

- GRC functionality like governance, compliance, incident reporting, and ESG – it is more efficient to manage these functions in the same risk management tool and integrate the data for enhanced reporting.

- Third-party risk management and vendor risk management to enable suppliers to carry out vendor risk assessments online via an external portal. Internal risk teams can build vendor profiles and score carding and formalise the onboarding and offboarding process.

- Cyber risk management and management for cybersecurity incident reporting to capture the digital aspects of risk management.

- Great customer reviews and high ratings from Forrester analysts.

- Cloud-based SaaS solutions to ensure instant access to new releases and features introduced by the GRC platform vendor.

- Poor-quality risk management data housed in spreadsheets due to a lack of data governance rules.

- Managing risk data across various forms, spreadsheets, emails and databases leads to inaccuracies and data entry errors.

- Those who don’t use a risk management system end up with disparate IRM data located in multiple spreadsheets – creating siloed risk data, and an inconsistent risk framework that results in inaccurate risk reporting outputs.

- Relying on manual, unautomated processes slows down the risk escalation and risk remediation process.

- A lack of integration between data sources makes it difficult to link risks to the most relevant controls in the control library.

- When organisations don’t use a top risk management tool, they are unable to compare risk across different sites, departments, and countries due to disparate data and inconsistent risk frameworks.

- If firms are not using a SaaS web risk management tool, the platform won’t receive regular patch updates and releases from the GRC software vendor, meaning the platform could become outdated or lack the latest functionality.

Access our online calculator tool to find out how much you could save in terms of cost and hours spent on managing risks if you were to move to an integrated risk and compliance platform. Simply complete the relevant details about how you currently manage risk in your organisation and our ROI calculator will provide high level estimates on the potential time and money you could save by implementing an integrated risk management tool.

Get started and request a demo of our integrated risk management tool

Fill out the form below to see the Camms’ integrated risk management platform in action.