GRC Solutions For the Financial Services Sector

A highly regulated industry like financial services demands a comprehensive regulatory compliance framework and an efficient risk management programme backed by strong governance.

Out-of-the-Box

Our best-practice solutions can be pre-configured to meet the specific needs of businesses in the financial services industry.

Single Source of Truth

Rapid time to Value

Out-of-the-Box

Our best-practice solutions can be pre-configured to meet the specific needs of businesses in the financial servoces industry.

Single Source of Truth

Our solution offers a single source of auditable truth for your risk and compliance programme.

Rapid time to Value

Our pre-built solutions are ready to be deployed and can be live within weeks.

Compliance Management

You’ll enjoy effective management of your compliance and regulatory change obligations.

Cloud-based

Our SaaS based software solution is hosted in the cloud for maximum flexiblity.

Demonstrable proof

Provide demonstrable proof of an effective risk & compliance programme to auditors and regulations.

Discover how the Camms Platform can help APRA-Regulated entities meet the requirements of the new APRA Standards

CPS 230 Operational Risk Management

CPS 234 Information security

Trusted by 150,000 Users worldwide

Protect your organisation with a comprehensive GRC platform for financial services

Transform your risk & compliance program

Watch our short video to understand how Camms is working with financial services organisation’s to simplify and streamline their risk & compliance programmes by using best-practice technology to minimise risk and achieve compliance.

Functionality to meet the needs of the

financial services sector

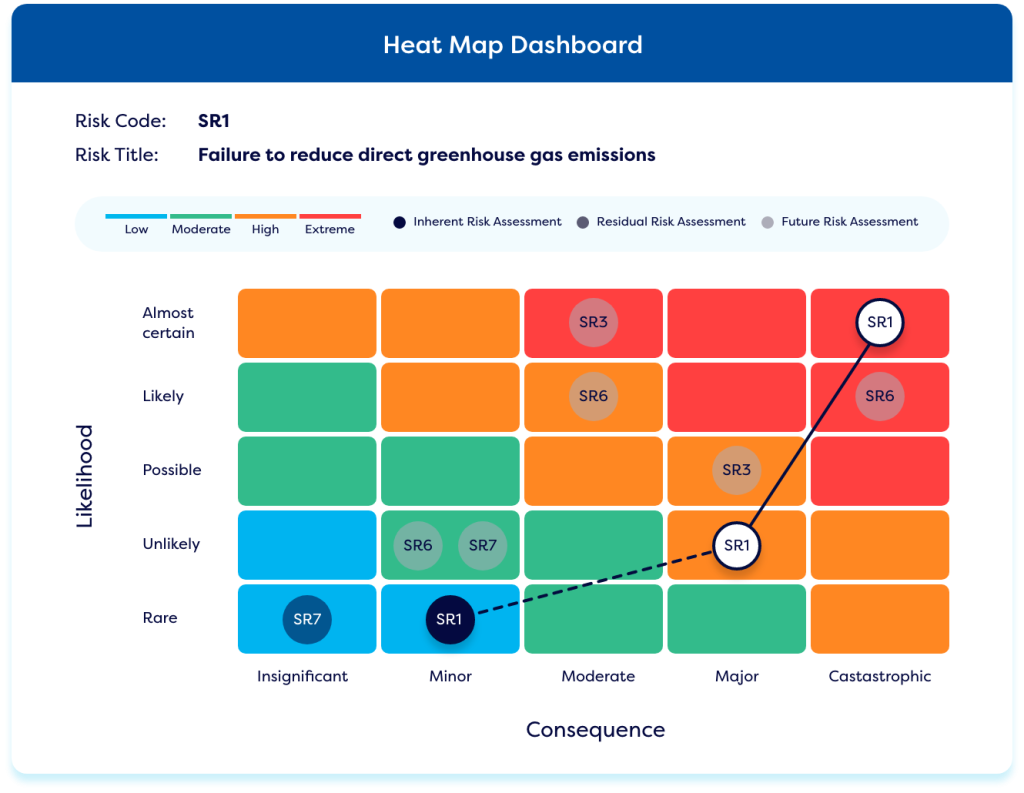

Risk Management

Create a culture where everyone is responsible for risk. Identify, track, and manage risk with confidence and link risk to your strategic objectives to achieve your goals.

- Establish a digital risk register and roll out risk assessments online.

- Set up a control framework to successfully manage risk.

- Monitor risk against KRI’s and your risk appetite.

- Use workflows to escalate risk and implement risk treatment actions.

- Dashboards & reports highlight key actions and provide a holistic view of risk.

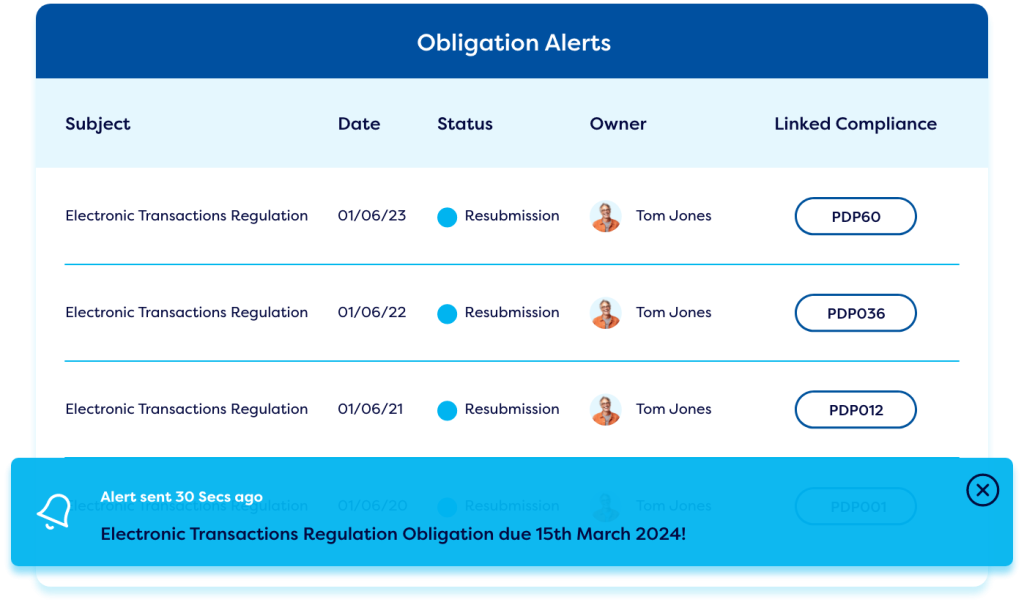

Compliance

- Build a detailed obligations library based on applicable regulations.

- Track progress against obligations and corrective actions.

- Automated regulatory change management linked to your third-party content provider.

- Use dashboards & reports to analyse your compliance profile.

- Provides an audit trail to demonstrate proof of compliance to regulators.

Cyber & IT Risk Management

Build a centralised view of IT and data privacy risk across your organisation via API integrations with other systems & data sources. Successfully manage cyber incidents & audits and keep a log of IT related equipment and usage.

- Digital risk & control library.

- Online risk assessments.

- Cyber incident management.

- Asset management log.

Strategic Planning

Turn your strategy into reality. Plan and execute your strategy using a best-practice framework to break down key goals into a series of projects, tasks & actions – and allocate them out across the organisation.

- Map out your strategic plan from high level goals to smaller tasks and actions.

- Use simple tree view to visualise your plan and track progress.

- Log spend and set KPI’s and scorecards to ensure your strategy is on track.

- Map risk to your strategic plans.

- Demonstrate how operational initiatives are contributing to high-level organisational objectives.

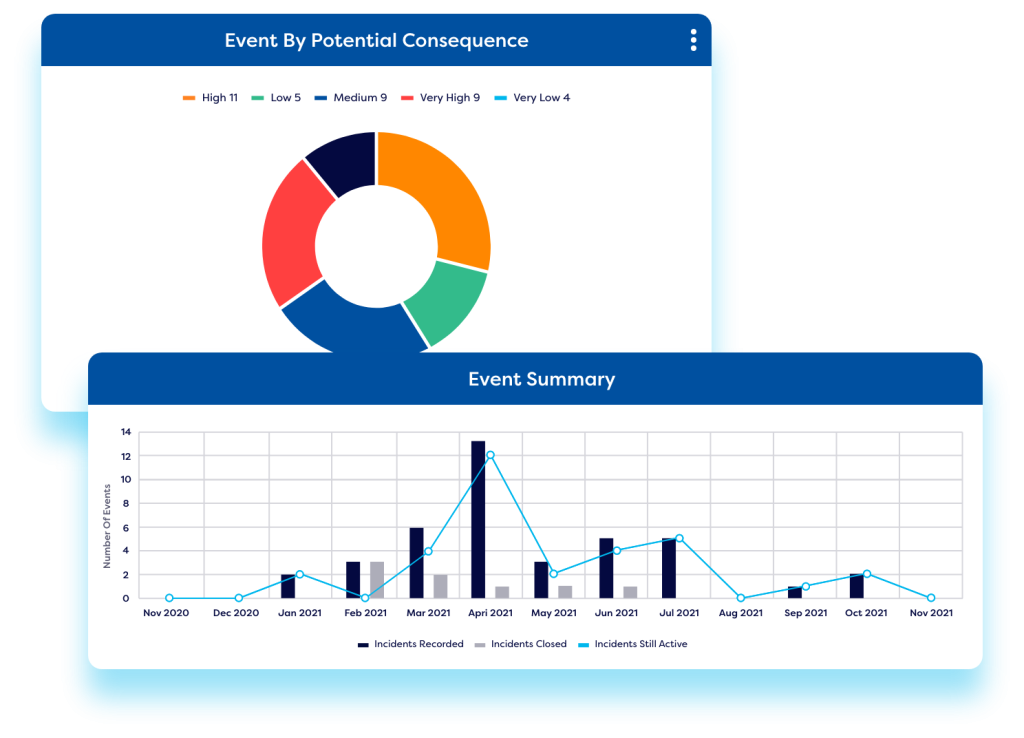

Incident Management

Report incidents, near misses, and emerging risks – conduct investigations, determine impact, and monitor cases until closed. Spot trends and introduce controls to reduce reoccurrence.

- Online incident forms feed directly into the platform.

- Third parties can log incidents via the vendor portal.

- Link incidents back to risks, processes, and staff to understand where incidents occur.

- Conduct investigations and perform route cause analysis.

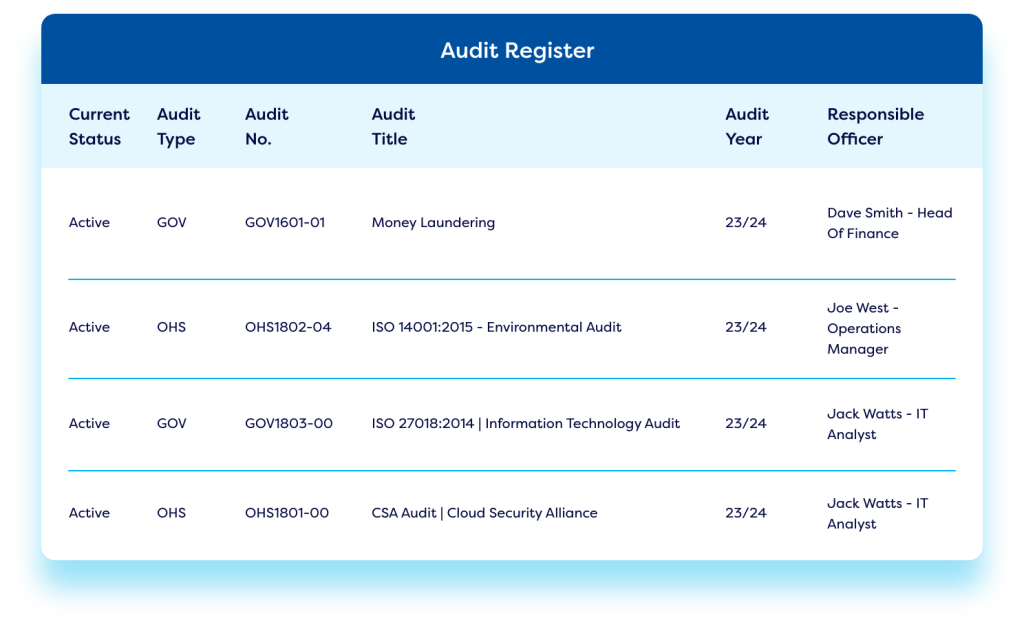

Audits

Schedule and prepare your audits. Use workflows & actions to effectively implement findings for the recommendations identified.

- Schedule and plan upcoming audits.

- Capture findings and follow up on recommendations.

- Link audits back to related risks or compliance obligations.

- Replicate existing audit setup details.

10 GRC Capabilities

Financial Firms Can’t

Do Without!

This eBook explores how financial services organisations are evolving their GRC programmes to generate risk intelligence, improve their understanding of business operations, and create an agile business model.

Related Resources

10 Steps to Achieve a Best Practice Regulatory Compliance Program

In this eBook, we explore the challenges around manual regulatory change management, we highlight the top 10 regulatory compliance issues, and we provide a step-by-step guide to help you achieve a best practice regulatory compliance program.

Building a Strong Business Case for GRC Automation

Download our latest eBook to understand what attributes a strong GRC business case for risk management software. Demonstrate the value a GRC tool can add to your organisation and understand the key steps to get your project over the line!

Business Intelligence for the C-suite: A New Vision for Operational Risk Management

The aim of this eBook is to banish the negativity and elevate the ‘Op Risk’ function from monotonous reporting and data aggregation to providing expertise to the c-suite to enable them to improve processes, make decisions, and drive competitive advantage.

Get started and request a demo

Fill out our simple form to see Camms’ business solutions in action.