Effective risk management is crucial for safeguarding your organisation’s assets & reputation and for ensuring long-term success. As threats and vulnerabilities become increasingly complex and operations become heavily reliant on systems and technology, the need for sophisticated tools to manage these risks has never been greater. This is where risk management software comes into play, offering a comprehensive solution to identify, assess, and mitigate potential risks.

However, not all risk management software is created equal. To ensure you choose the right tool for your needs, here are fifteen must-have risk management software features that will empower your team to manage risks efficiently and effectively.

- Unlimited Risk Registers & Types – Look for a risk management tool that enables you to build an unlimited number of risk registers with differing categories and types. This will make it easy for teams to build multiple digital risk registers within the platform and report on risk across multiple teams, sites, and departments. This approach will enable leaders to drill down into risk in certain areas and view risk across the enterprise as a whole. Look for tools that offer data governance in the form of drop downs, searchable fields, and mandatory fields to ensure risk data is entered consistently across every site and team.

- Online Automated Risk Assessments – Look for a risk management tool that enables you to roll out your risk assessments online. Access the best practice forms and templates within the tool to design risk assessment forms that work for every area of your organisation – capturing critical details. Automated workflows can be used to send out regular risk assessments via email – eliminating the need for manual form circulation. Reminders are automatically sent when forms are not completed within the required timeframe. As staff complete risk assessment forms, all data flows directly into the risk management software linked to the relevant risk – collecting adequate data for risk monitoring purposes. This automation streamlines the process and cuts out on admin and duplicated effort and ensures data is completed on time in the right format to generate more accurate reporting outputs.

- Digital Control Library– Choose a risk management platform that offers the functionality to create a control library – enabling you to set controls for each risk in the risk register. Use the platform to build a digital library of controls – these controls might be policies, procedure documents, step-by-step processes, regular checks, or safety or security equipment. Choose a solution that enables you to conduct control monitoring and carry out regular control testing to ensure each control is effective. Ensure the platform you opt for enables you to map and link multiple risks and controls to build a complete picture of each risk, how it is being managed, and its effectiveness.

- Risk Appetite Functionality – Look for solutions that enable your firm to define a risk appetite and operate within it. You should be able to set Key Risk Indicators (KRIs) for each risk in the risk register and monitor the risk levels by viewing operational data and carrying out risk assessments. When risk levels become too high, firms will be alerted so they can implement additional controls and remediating actions to keep with within the desired tolerances.

- Risk Escalation & Mitigation Workflows – Of course some risks will reach a high level and will need to be addressed. Therefore, firms should look for a risk management platform with risk escalation and risk mitigation workflows. This functionality means that once a risk level is too high. the relevant stakeholders will receive notifications enabling them to take action. Each action they take and the resulting outcomes are documented, providing a complete audit trail of how and when the risk was treated and who by.

- Customizable – Look for a risk management tool that is easy for your teams to customise and configure in-house without the need for costly professional services fees and coding from the software vendor. Most risk management platforms offer a variety of out-of-the-box, risk registers, workflows, templates, frameworks, forms, and reports that align with industry best-practices in risk management, but most companies will have some additional fields, reports, escalation processes, or internal terminology that they will need to incorporate within the system. Choosing a highly configurable platform is essential to ensure the platform works for your organisations bespoke needs and will ensure that the platform can scale and grow as your risk management program matures.

- User Permissions Hierarchy – Look for a platform that offers a user permissions hierarchy. This will enable firms to set guidelines around what each user can do in the platform. Core operational staff will be able to access the system to complete simple tasks like online risk assessments and control checks and control testing. Middle managers and team leaders will have more access to add risks to the risk register and approve risks and they will also receive notifications about high risk levels and outstanding risk assessments and control checks in their area. Leadership teams will have access to high-level risk overview dashboards to understand risk exposure across the entire enterprise. Each user would essentially have their own ‘dashboard’ view where they can see their upcoming tasks and approvals and key stats relating to their areas of responsibility.

- API Integrations – Look for a risk platform that enables API integrations with your other systems and data sources. This will allow you to pull operational data from other systems and spreadsheets into the risk management tool to monitor risk levels. This ensures a single source of truth in your risk management program and subsequent reporting outputs as everyone is working from the same data set. It also eliminates data transfer errors and admin tasks. APIs can pull data from financial systems, operational databases, and other relevant sources to enrich risk assessments leading to better decision-making.

- Incident Management – The synergy between risk management and incident reporting is undeniable, with numerous risks translating into significant incidents and incident causes often finding their way onto the risk register. Therefore, it is important to choose a risk management platform that offers best-practice incident reporting capabilities in the same software solution. Employees should be able to log incidents via online forms capturing all data, including date, time, employees involved, photos, document evidence, and URLs etc. Once an incident is logged, it will be escalated according to the agreed escalation route and from there, automated workflows enable the team to log remediating actions and steps to resolve the incident. Look for tools that enable you to map incidents back to the originating risks, this will support enhanced reporting outputs and enable firms to allocate budget & resources to reducing the most critical incidents and risk areas.

- Link Risk to Strategic Goals & Objectives – Look for platforms that enable you to manage risk in line with strategic objectives and enterprise performance. Many GRC platforms with risk management capabilities enable you to plan and deliver your strategy in the same platform. This enables firms to take certain risks in pursuit of their strategic objectives and avoid risk in areas that will negatively impact their objectives. The same can be done for ‘enterprise performance’. Taking a risk can either have a positive or negative impact on operational performance, understanding this correlation will help organisations take the right risks and avoid those that will have a detrimental impact on their performance.

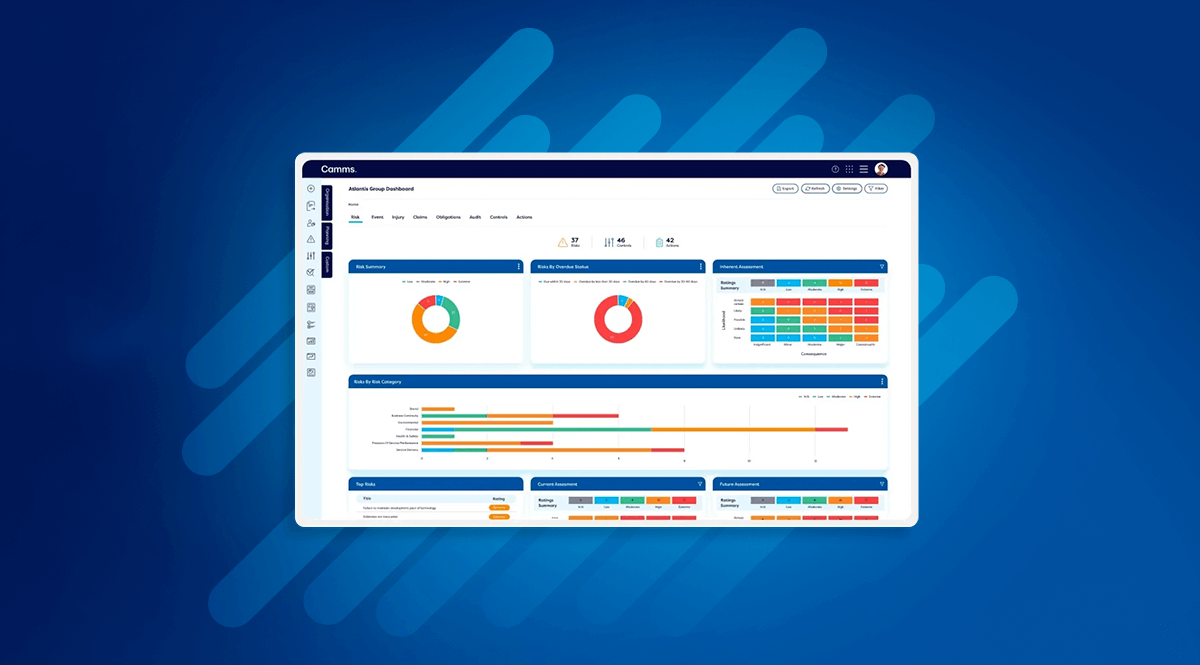

- Automated Reporting Outputs – Look for solutions that offer a variety of risk reports straight out-of-the-box. Many platforms offer data visualization reports like heat maps, bow tie analysis, and even Microsoft Power BI drillable dashboards. Think about the reporting outputs you would need to extract from the tool and make sure the platform you select can accommodate those requirements. Automated reporting saves risk teams copious amounts of time – enabling them to focus their efforts on strategic risk mitigation strategies. Look for risk solutions that offer executive and external reporting outputs for leaders and external parties that don’t have access to the platform but want to view live data outputs to get an instant view of risk exposure.

- Aligns with Popular Risk Management Frameworks – Many organisations are required to manage risk in line with certain frameworks and mandatory guidelines including COSO, Basel III, SOX, ISO 31000, CPS 230, NIST, HIPAA, and even some data privacy regulations like GDPR and PSI DSS. Therefore, be sure to choose a risk management platform that offers best-practice frameworks to structure your operations in line with these requirements.

- Offers Wider GRC Capabilities – Of course risk management is a core function in most organisations but when risk management practices are integrated with other core GRC functions like, compliance, incident management, ESG, policy management, project management, health & safety, and corporate governance, it provides a much deeper integrated approach to risk management that drives valuable reporting outputs. Look for a tool that offers multiple GRC capabilities in one holistic platform, you might not need every capability upon initial implementation, but it will be beneficial to have the functionality available in the future as you scale and mature your risk management program.

- Highly Rated by Analysts & Customers – With so many risk management platforms to choose from, it is best to opt for a solution that is highly rated by leaing analyst and customer review sites. Look for vendors who appear in the Forrester WaveTM Governance, Risk & Compliance Platforms Q4 2023. Camms featured in the latest, wave, we were ranked as a ‘Strong Performer’ and were one of the only vendors to score 5/5 for our ERM capabilities. Be sure to check out our customer reviews on the Software comparison site G2 to see how users have rated our risk management software.

- Built On Modern Technology – Be sure to choose a risk management platform that is built on the latest modern technology making it stable and secure. Look for platforms that comply with cyber security certifications like SOC Type 1 & 2, ISO 27001, and Cyber security essentials. Be sure to look for platforms that are responsive and intuitive to use with sub second screen loading times and no buffering. This will make it faster for staff to carry out tasks and ensure wider adoption of the platform. Look for risk solutions that offer a mobile app – enabling staff to carry out risk related tasks, actions, risk assessments, and control checks on the move.

With new digital and operational risks emerging every day, effective risk management is more important than ever for safeguarding your organisation’s assets & reputation and ensuring long-term success. As operational reliance on systems and technology grows, so does the need for sophisticated tools to manage emerging threats and vulnerabilities. Risk management software provides a best-practice framework to identify, assess, and mitigate potential risks.

However, not all platforms are created equal. To ensure you select the right risk tool for your needs, be sure to consider the fifteen must-have features in this blog. By integrating unlimited risk registers, automated assessments, a digital control library, risk appetite functionality, escalation workflows, customization options, a user permissions hierarchy, API integrations, incident management, strategic goal linkage, automated reporting, and wider GRC capabilities, and ensuring the solution has high ratings from analysts & customers, is built on modern technology, and offers alignment with key risk frameworks, you can empower your team to manage risks efficiently and effectively. Choose wisely, and you’ll be well-equipped to navigate the complexities of risk management with confidence and precision.

The Camms risk management platform offers all of the functionality we mentioned in the blog and more. Request a demo to see how our platform could streamline and automate your risk management processes.