Regardless of size and sector, organisations face many risks that could significantly impact their business operations, finances, and reputation. Business risk analysis is a powerful way to help businesses anticipate potential threats that may jeopardize their operations and long-term strategic plans. A multi-step process, business risk analysis ensures that all aspects of the company are protected from possible threats by understanding risk exposure and implementing sufficient controls.

Read this blog to understand what business risk analysis is and why it is important to the success of any business strategy. Explore the approach your organisation can take to assess business risk, learn how business risk analysis can be leveraged to lower risk levels, and discover how risk management software can support best-practice business risk analysis.

What is Business Risk Analysis?

Business risk analysis is a first-line defense technique used to identify and assess business risks and their causes – it explores the potential impacts of risk, and aids in developing appropriate mitigation strategies to protect the organisation. The process involves working with stakeholders across the business and evaluating the potential risks that might hurt a business and involves quantifying the severity of each potential risk to determine and inform a risk control framework.

In the context of the business world, types of risk to consider include any strategic risks, reputational risks, operational risks, enterprise risks, compliance risks, IT & cyber risks, and environmental risks. Firms should also consider identifying any potential opportunities that could be capitalized on by taking a risk and assessing the likely outcomes. Organisations must categorize their risks and assess them for possible impacts and likelihood of occurrence to inform their decision-making process regarding the implementation of controls and mitigating actions. This allows leadership to plan and prepare for potential issues, and effectively reduce the negative impact of risk by implementing risk treatment actions and controls.

Conducting regular business risk analysis also prepares the organisation for changes in the business environment including evolving regulatory changes, market fluctuations, geopolitical risk, and risks arising from new technology and allows them to allocate necessary resources where needed to efficiently manage the impact of those risks when and where they occur.

Why is Business Risk Analysis Important?

Business risk analysis is a pre-requisite for best practice risk management and allows organisations to understand and manage problems that could undermine daily business operations, new business initiatives, and projects. It guarantees that effective controls and contingency plans are in place if specific scenarios were to occur – protecting the long-term sustainability of an organisation.

The goal of business risk analysis is to ensure the organisation’s risk management process increases the chances of the organisation successfully achieving its long-term strategic objectives. It also facilitates better visibility for leadership and the organisation as a whole to gain a common understanding of what risks exist and how they could affect the business if not treated. Business risk analysis should be aligned with the organisations strategy to ensure the organisation is taking the right risks to achieve strategic goals while mitigating unwanted risk that could impact strategic plans. Business risk analysis data is important as it is essential for business leaders to understand where to allocate budget and resources to reduce risk in the most critical areas.

What Approach Should Your Organization Take to Understand Business Risk?

Adopting a structured best-practice approach to Enterprise Risk Management (ERM) is the best way to capture sufficient risk data to perform business risk analysis. Furthermore, using quantitative and qualitative tools to assess risk probabilities can help you grasp the impact and severity of unaddressed risks. Let’s take a look at the key processes needed to capture sufficient risk data to enable your organisation to perform business risk analysis.

Identify Risk: Risk teams should work with stakeholders across different departments and sites to identify the key risks facing their organisation across all departments and locations. These should be captured in a centralised ‘risk register’, categorized according to their type, and rated based on their likelihood, severity and impact. At this stage, Key Risk Indicators (KRIs) should also be established for each risk to understand current risk status and to monitor fluctuations in risk levels.

Understand Risk Levels: There are several ways for an organisation to monitor risk levels and risk exposure. Risk assessments are a common way to monitor risk levels. Risk Assessment is a qualitative analysis process of understanding risk levels within a business. Risk assessments are usually carried out on different business areas at regular intervals and usually involve operational staff submitting answers to a list of questions relating to the current risk levels. The completion of these assessments provides a wealth of data to carry out business risk analysis.

Most businesses also use transactional and operational data to monitor risk levels. This could often be financial data, HR data, delivery data and other data types that could be a considered a ‘Key Risk Indicator’. When using a GRC platform to manage risk, this data can be pulled into the platform from other systems and sources via API integrations and linked to the relevant risk – allowing companies to understand risk levels in real-time and build a complete picture of risk exposure.

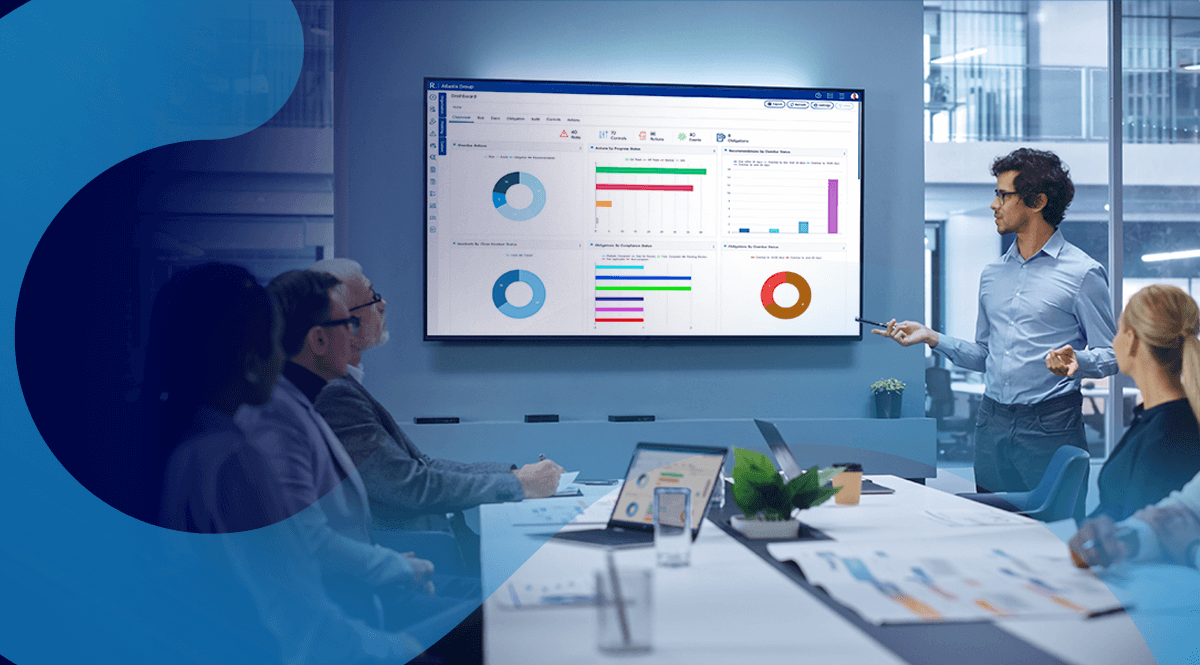

Analyzing Risk Data: This stage involves analyzing and visualizing risk data to identify patterns, correlations, and outliers that could indicate fluctuations in risk levels. When managing risk in a GRC platform, teams can leverage various data analysis and visualization tools such as dashboards and heat maps to display the data in an accessible way to identify risk factors, evaluate probabilities, and support the need for risk mitigation strategies.

Whether using a risk platform or manual methods, being able to produce adequate risk reporting and visualizations is vital to enable sufficient business risk analysis. Reports like risk register summaries, RAG status, heat map reports, and bow tie visualizations are great ways to analyze risk data.

How can Organisations use Business Risk Analysis to Lower Risk Levels?

By conducting a thorough business risk analysis your risk team can gauge the likelihood of potential risks and their impact if left unaddressed. They can then be prioritized based on severity, and the organisation can then implement effective mitigation plans to lower risk levels – fostering a culture of proactive risk management.

Implement a Risk Control Framework: ‘Risk controls’ are essentially measures that can be taken to eliminate or reduce the likelihood or impact of each risk. Implementing appropriate and effective ‘risk controls’ involves organisations implementing procedures, processes, policies, checks, or equipment to lower risk levels. Controls should be logged in a ‘control register’ and mapped to the relevant risks they are related to.

Control Checks & Testing: Once the relevant controls have been established for each risk, firms should carry out control checks to ensure the controls are effective. Control checks should be carried out at regular intervals to ensure they are working. Control checks and tests might involve ascertaining if a policy or procedure is being followed, or it might involve checking safety or security equipment is functioning correctly. These checks are essential to identify any gaps in your control environment. When controls are failing, it is important to put measures in place to escalate and resolve things quickly to prevent risk levels from rising. Maintaining a control library is an ongoing process for a business – as projects mature, new risks develop, or anticipated risks disappear meaning the corresponding controls need to be amended. Effective risk monitoring and control processes provide information that assists with making effective decisions in advance of the risks occurring.

Control Analysis: It is important to carry out control analysis to make sure that the controls are fit for purpose. For example, a policy for health & safety might exist, but is it actually lowering the risk of incidents? Therefore, companies must analyze control data alongside risk data for context. If a control failed, but KRIs remained the same, is that control really needed or is it ineffective. If risk levels rise to intolerable levels but all the controls are working, do further controls need to be implemented and what would that cost? Business risk analysis data can provide vital answers to those questions and help organisations decide where to spend money and resources to reduce risk.

How can Risk Management Software Support with Business Risk Analysis?

When organisations use risk management software for their risk management processes, business risk analysis becomes much easier. The platform houses all your essential risk management data including your risk register, operational data used for KRIs, risk assessment results, incident data, controls, and the results of control checks and testing. With all this data held centrally, the platform can provide a wide variety of reporting outputs and dashboard visualizations to aid business risk analysis.

To gain further visibility into how risk could impact enterprise performance and strategic plans, many risk management platforms enable firms to manage strategic planning and enterprise performance in the same platform as risk. This enables firms to understand the impact of risk on strategic objectives and enterprise performance through advanced analytics – supporting firms to take calculated risks in areas where the benefit outweighs the risk.

By employing risk management best practices and the right software, businesses can enhance their resilience, ensure long-term success and sustainability, and maintain a competitive edge in the market.

Implementing best practice risk management process using a risk management platform requires time, effort, resources, and planning, but once the initial set up is completed, the benefits far outweigh the costs.

A best-in-class risk management software platform makes it easy for the entire organisation to feed into the risk management process – from operational staff completing online risk assessments and control checks right up to the board who are using risk data to make vital decisions regarding the direction of the business. These platforms also support businesses to balance risk-reward trade-offs and align their risk appetite and tolerance with strategic goals. Leveraging risk management software enables risk teams to implement effective risk controls and mitigation strategies.

Understanding the significance of risk and its impact on your organisation is vital for long term sustainability and growth. Keen to learn how Camms can help your organisation identify potential risks, rank them, and make a plan to effectively mitigate them? Simply request a demo today!