GRC Software For the Insurance Sector

Out-of-the-Box

Our best-practice solutions can be pre-configured to meet the specific needs of the education sector.

Single Source of Truth

Rapid time to Value

Out-of-the-Box

Single Source of Truth

Rapid time to Value

Compliance Management

Cloud-based

Demonstrable proof

Trusted by 150,000 Users worldwide

A comprehensive GRC platform designed to protect the insurance sector

Functionality to meet the needs of the

insurance sector

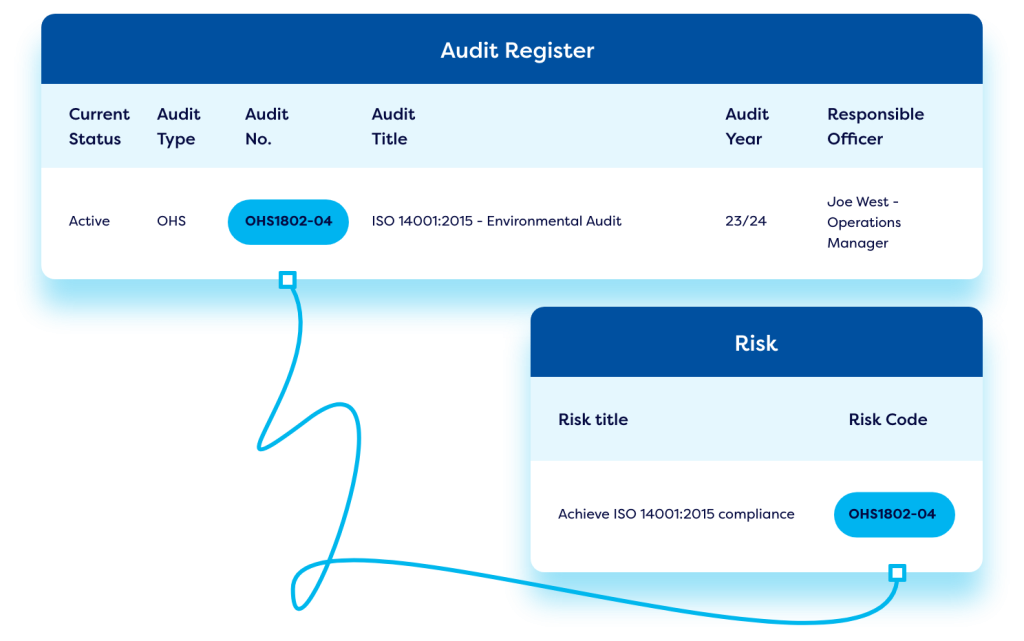

Risk Management

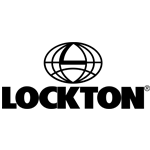

- Implement a digital risk register and conduct online risk assessments.

- Develop a control framework to effectively manage risks.

- Track risks against Key Risk Indicators (KRIs) and align them with your risk appetite.

- Use workflows to escalate risks and carry out risk treatment actions.

- View dashboards and reports to understand critical tasks and get a comprehensive view of risk exposure.

Compliance

- Create a comprehensive obligations library containing relevant regulations

- Monitor compliance obligation status and corrective actions.

- Automate regulatory change management based on live regulatory feeds from your preferred third-party content provider.

- View dashboards and reports to analyze your compliance status.

- Maintain an audit trail to provide proof of compliance to regulators.

Strategic Planning

- Fully document your strategic plan - from overarching goals to detailed tasks and actions.

- Visualize your plan and track progress using detailed tree views.

- Record spending, manage budgets, and establish KPIs & scorecards to keep your strategy on track.

- Link risk to your strategic plans for better organisational alignment.

- Show how operational initiatives support your organisation’s high-level objectives.

Incident Management

- Data from online incident forms is automatically integrated into the platform.

- Set up a vendor portal to enable your thirdparties to log incidents.

- Link incidents to risks, processes, and personnel to understand the correlations.

- Conduct thorough investigations and perform root cause analysis to identify underlying issues.

Audits & Inspections

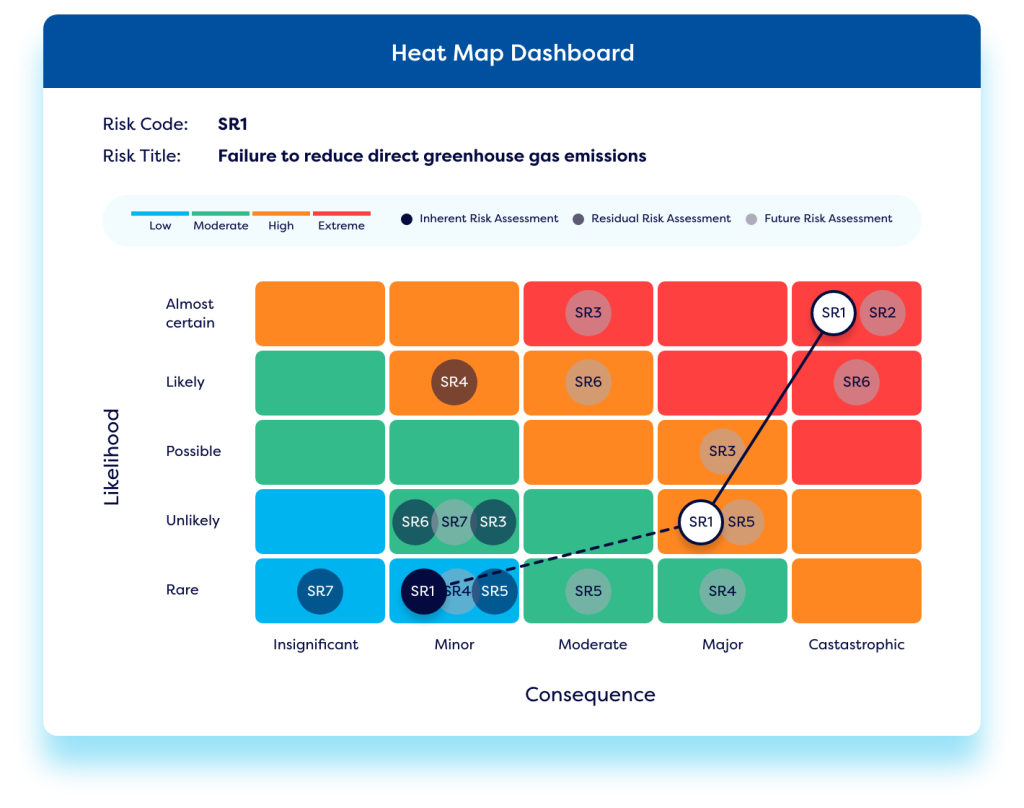

- Schedule and organize upcoming audits.

- Record findings via online forms and use workflows to track progress on recommendations.

- Connect audits to relevant risks or compliance obligations.

- Replicate audit setup details for consistency across audits.

Cyber & IT Risk Management

- Establish a cyber risk & control library.

- Conduct online cyber risk assessments.

- Establish a cyber incident management process.

- Create an asset management log.

Managing Governance, Risk & Compliance in Insurance: 10 Must-Have GRC Capabilities

In this eBook, we explore 10 key GRC capabilities that every insurance firm should be using. It explains how firms can automate risk management and compliance processes to gain better oversight to guide decision-making.

Related Resources

10 Steps to Achieve a Best Practice Regulatory Compliance Program

In this eBook, we explore the challenges around manual regulatory change management, we highlight the top 10 regulatory compliance issues, and we provide a step-by-step guide to help you achieve a best practice regulatory compliance program.

Building a Strong Business Case for GRC Automation

Download our latest eBook to understand what attributes a strong GRC business case for risk management software. Demonstrate the value a GRC tool can add to your organisation and understand the key steps to get your project over the line!

Effectively Managing Risk: A Guide for Insurance Companies

In the insurance industry, risk is a constant presence, menacingly threatening to disrupt operations and challenge profitability. Insurance companies play a crucial role in safeguarding

Get started and request a demo

Fill out our simple form to see Camms’ business solutions in action.